Teongjang Jjal: Unpacking The Viral Empty Wallet Memes

In the fast-paced, often financially demanding world we live in, few things resonate as universally as the shared experience of an empty wallet or a dwindling bank account. Enter "Teongjang Jjal" – a phenomenon that has swept across online communities, particularly in South Korea, offering a humorous yet poignant reflection on our financial realities. These aren't just any memes; they are a collective sigh, a knowing nod, and sometimes, a desperate plea for financial relief, all wrapped up in a relatable image or short clip.

From the moment payday hits to the inevitable and often rapid disappearance of funds, the journey of our money is a rollercoaster. "Teongjang Jjal" captures every twist and turn of this ride, transforming personal financial woes into a source of shared laughter and understanding. This article delves deep into the world of these compelling memes, exploring their origins, their cultural significance, and the deeper conversations they spark about our relationship with money.

Table of Contents

- What Exactly is "Teongjang Jjal"? Unpacking the Empty Wallet Meme

- The Universal Language of Financial Woes: Why Teongjang Jjal Resonates

- A Gallery of Relatable Struggles: Popular Teongjang Jjal Themes

- Beyond the Laughter: The Deeper Implications of Teongjang Jjal

- Teongjang Jjal as a Mirror: Reflecting Modern Spending Habits

- Leveraging Teongjang Jjal for Positive Change: From Humor to Habit

- Navigating Financial Wellness: Practical Steps Beyond the Meme

- The Future of Financial Memes: Teongjang Jjal and Beyond

What Exactly is "Teongjang Jjal"? Unpacking the Empty Wallet Meme

To truly understand "Teongjang Jjal," we first need to break down its components. "Teongjang" (텅장) is a clever Korean portmanteau combining "teong" (텅), meaning 'empty,' and "tongjang" (통장), meaning 'bank account' or 'passbook.' So, literally, it means 'empty bank account.' "Jjal" (짤) is a widely used Korean slang term for an image, GIF, or short video clip, often shared online for humorous or expressive purposes, akin to the English word 'meme.'

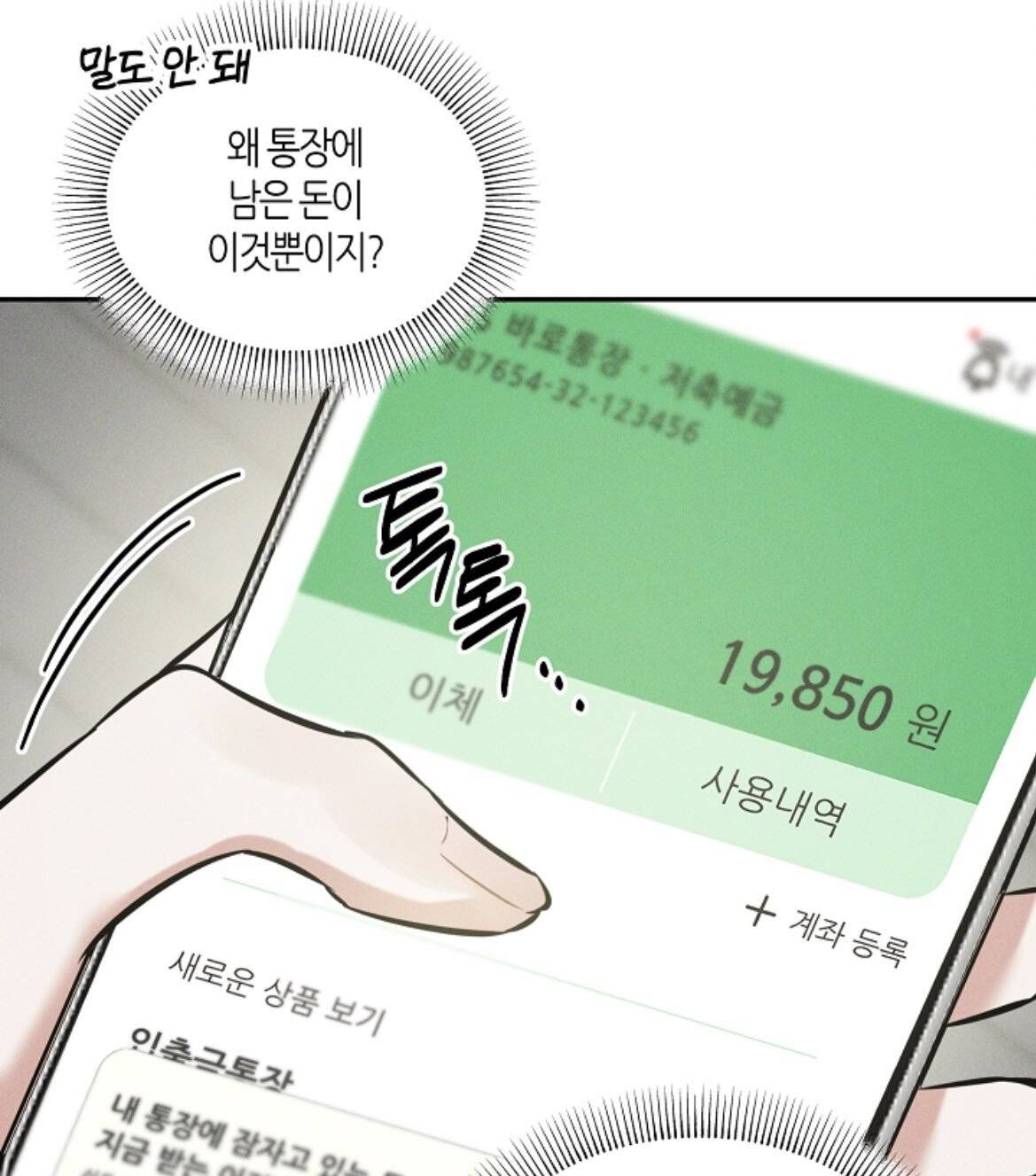

Put together, "Teongjang Jjal" refers to a category of memes, images, or GIFs that vividly depict the state of having an empty bank account or experiencing financial hardship. As one online community aptly describes it, it's "a blog collecting various memes used when you have no money." These visuals often capture the immediate aftermath of payday spending, the shock of seeing a near-zero balance, or the general feeling of being broke. It's a relatable sentiment that transcends borders, but has found a particularly strong voice within Korean online culture.

The core appeal of a "Teongjang Jjal" lies in its ability to encapsulate a complex, often stressful, financial reality into a simple, digestible, and often humorous image. It's a shared experience that many can instantly connect with, fostering a sense of community and empathy among those who find their wallets mysteriously lighter than they should be. It’s not just about being broke; it’s about the journey to getting there, often fueled by impulsive spending or unavoidable expenses.

The Universal Language of Financial Woes: Why Teongjang Jjal Resonates

While "Teongjang Jjal" originated in Korea, its resonance is undeniably global. The struggle with managing finances, the fleeting joy of payday, and the subsequent dread of an empty bank account are experiences that transcend cultural boundaries. These memes tap into a universal human truth: money, or the lack thereof, is a significant part of our daily lives and a common source of stress. When we see a "Teongjang Jjal," we often find ourselves nodding in agreement, thinking, "This is so me!"

Humor, in this context, serves as a powerful coping mechanism. Financial stress can be isolating and overwhelming. By transforming these anxieties into a shared joke, "Teongjang Jjal" helps to lighten the emotional burden. It creates a space where people can acknowledge their financial struggles without feeling ashamed or alone. As one user shared, "Funny but sad teongjang meme collection," perfectly encapsulating the bittersweet nature of these visuals. They make us laugh, but they also remind us of a truth that can sometimes sting.

Moreover, these memes foster a sense of solidarity. When someone posts a "Teongjang Jjal," they're not just sharing a picture; they're inviting others to commiserate. Comments often pour in with similar experiences, like, "Teongjang just one day after getting paid.... Am I the only one? *sobs*." This collective acknowledgment normalizes financial struggles, making it easier for individuals to talk about money, even if indirectly, and realize they are part of a larger community facing similar challenges. It's a testament to how internet culture can create bridges of understanding through shared humor.

A Gallery of Relatable Struggles: Popular Teongjang Jjal Themes

The world of "Teongjang Jjal" is rich with diverse themes, each capturing a specific facet of the financial struggle. These memes often feature popular characters, relatable scenarios, and witty captions that hit home for anyone who's ever watched their money vanish into thin air. Let's explore some of the most common and beloved "Teongjang Jjal" categories that populate our feeds:

The Post-Payday Plunge

This is perhaps the most iconic theme within the "Teongjang Jjal" universe. It depicts the rapid descent from financial abundance to scarcity immediately after receiving a paycheck. The narrative often goes something like this: "Spending money like this for 3 days after getting paid, then being poor for the remaining 27 days. But seriously, I'm always like this!" These memes perfectly illustrate the fleeting joy of a full bank account, quickly followed by the harsh reality of bills, impulsive purchases, and daily expenses. Images might show a character celebrating wildly with money, only to be reduced to rags in the very next frame, symbolizing the swift depletion of funds. It's a cycle many office workers and young adults know all too well, making these memes incredibly popular for their raw honesty.

The Sudden Disappearance of Funds

Another highly relatable "Teongjang Jjal" theme revolves around the mysterious vanishing act of money. It's the moment you check your bank balance, expecting a certain amount, only to find it drastically lower than anticipated. "It's only been about 2 weeks since I got paid, but it just disappeared from my account?" This sentiment is often accompanied by images of shock, disbelief, or a character frantically searching for lost money. These memes highlight the feeling of being caught off guard by expenses, subscriptions, or past splurges that suddenly materialize as deductions. The humor comes from the shared bewilderment and the inability to comprehend where all the money went, often leading to a stark "only +0 left" revelation.

The "Beggar" Meme

When the wallet is truly empty, and the bank account echoes, the "beggar" meme comes into play. These "Teongjang Jjal" often feature characters in a state of destitution, humorously begging for money or lamenting their poverty. One popular example mentioned is "a collection of beggar memes for friends with no money." These memes are used to playfully (or sometimes genuinely) express extreme financial hardship, often directed at friends in group chats to signal an inability to participate in expensive activities. Images might include iconic characters like Giyoungie from "Black Rubber Shoes" or Spongebob Squarepants in a state of despair, representing the ultimate "no money here" situation. They are a lighthearted way to communicate a serious financial state.

The "Salary Just Passes By" Phenomenon

This theme captures the feeling that salary isn't something that stays but merely a transient visitor. "Salary is just something that passes by. Celebrating becoming teongjang," perfectly encapsulates this idea. These "Teongjang Jjal" often show money literally flying away, slipping through fingers, or being instantly consumed by various expenses like card bills. It's a visual metaphor for the rapid outflow of funds that often accompanies payday, leaving little to nothing behind. This theme particularly resonates with individuals who feel their income is primarily dedicated to covering existing debts or essential living costs, leaving no room for savings or discretionary spending. It's a poignant reminder of how quickly financial resources can be depleted in modern life.

Beyond the Laughter: The Deeper Implications of Teongjang Jjal

While "Teongjang Jjal" primarily serves as a source of humor and shared commiseration, their widespread popularity points to deeper societal and personal implications. These memes, though lighthearted, often touch upon the very real anxieties surrounding financial stability and the challenges of modern consumer culture. They are a mirror reflecting common financial literacy gaps and the emotional toll of economic pressure.

One significant implication is the candid acknowledgment of financial stress. In many cultures, discussing money, especially personal financial struggles, can be taboo. "Teongjang Jjal" provides an indirect, socially acceptable outlet for expressing these anxieties. When someone posts a meme about their "bank balance hurtling towards ruin" or lamenting that "it's year-end, so I have even less money... Many places to spend, but when will salary come in?", they are articulating a genuine concern that many others share. This shared experience can reduce feelings of isolation and shame associated with financial difficulties.

Furthermore, these memes highlight a common coping mechanism: using spending to alleviate stress. The phrase "Relieve stress with money. I wish nobody knew me and I had a lot of money" perfectly captures this impulse. While a temporary fix, this behavior often contributes to the very "Teongjang" state being joked about. The memes, therefore, subtly bring to light the psychological aspects of spending and the often-unhealthy relationship many have with their finances, where instant gratification or emotional comfort takes precedence over long-term financial health. They serve as a cultural barometer for the prevailing economic sentiments and individual financial behaviors.

Teongjang Jjal as a Mirror: Reflecting Modern Spending Habits

"Teongjang Jjal" memes are more than just funny pictures; they are a candid reflection of contemporary spending habits, particularly among younger generations and urban dwellers. They highlight the pervasive influence of consumerism, the ease of online shopping, and the often-invisible drains on our bank accounts that lead to the dreaded "Teongjang" state. The memes serve as a stark, albeit humorous, reminder of where our money often goes.

One common theme is impulsive or excessive spending. As one user admitted, "Lately, I've been spending so much money on useless things. To motivate myself, I'm collecting teongjang memes from various places." This self-awareness, triggered by the empty wallet, underscores how easily discretionary spending can spiral out of control. Events like Black Friday are frequently cited as culprits, with posts like "Black Friday splurge review... just became a beggar," illustrating the immediate and often severe financial consequences of chasing deals and trends.

Moreover, the memes implicitly touch upon the burden of recurring expenses and debt. Mentions of "card bills" and the feeling of "salary logout" after all deductions reveal how much of one's income is pre-allocated before it even fully hits the account. The constant stream of subscriptions, loan payments, and essential living costs means that for many, a full bank account is a fleeting illusion. "Teongjang Jjal" therefore acts as a social commentary, exposing the financial pressures faced by individuals trying to navigate a world that constantly encourages consumption while simultaneously demanding financial prudence.

Leveraging Teongjang Jjal for Positive Change: From Humor to Habit

While "Teongjang Jjal" memes are primarily about humor and commiseration, their very existence can be a powerful catalyst for positive change. The shared laughter often serves as a wake-up call, prompting individuals to reflect on their own financial behaviors and consider adopting healthier money habits. When the humor wears off, the underlying message of an empty bank account can become a strong motivator.

For many, seeing a relatable "Teongjang Jjal" can be the nudge needed to re-evaluate spending. The meme itself, particularly those that highlight the rapid disappearance of funds, can act as a visual reminder of financial vulnerability. As one user put it, "When you don't want to work, look at your teongjang." This simple yet profound statement suggests that the discomfort of an empty account can be a powerful motivator for productivity and, by extension, better financial management.

These memes can also open doors for conversations about financial literacy. By normalizing the discussion of being broke, they create an environment where people might feel more comfortable seeking advice or sharing tips on budgeting, saving, or investing. While the memes themselves don't offer solutions, they highlight the problem in a way that encourages self-reflection and a desire for improvement. They transform a potentially embarrassing situation into a shared challenge, paving the way for collective learning and growth in financial responsibility.

Navigating Financial Wellness: Practical Steps Beyond the Meme

While "Teongjang Jjal" offers a cathartic release through humor, it's crucial to move beyond the laughter and address the underlying financial realities. Achieving financial wellness isn't about magic; it's about consistent, mindful habits. If the "Teongjang Jjal" resonates a little too strongly with your personal experience, here are some practical, general steps you can take to move towards a fuller bank account:

- Track Your Spending: The first step to financial control is knowing where your money goes. Use budgeting apps, spreadsheets, or even a simple notebook to log every expense. You might be surprised at how quickly small, seemingly insignificant purchases add up. Understanding your outflow is key to identifying areas for reduction.

- Create a Realistic Budget: Based on your spending habits, create a budget that allocates funds for necessities (rent, food, utilities), savings, debt repayment, and a realistic amount for discretionary spending. The goal is to live within your means and ensure you're not spending more than you earn.

- Set Financial Goals: Whether it's building an emergency fund, saving for a down payment, or paying off debt, having clear financial goals provides motivation. Break down large goals into smaller, achievable steps. This gives purpose to your saving efforts beyond just avoiding "Teongjang."

- Automate Savings: Set up automatic transfers from your checking account to a savings account immediately after payday. Even a small amount consistently saved can grow significantly over time. This "pay yourself first" strategy ensures that savings aren't an afterthought.

- Identify and Cut Unnecessary Expenses: Review your subscriptions, eating out habits, and impulse purchases. Are there services you no longer use? Can you cook at home more often? These small cuts can free up significant funds that can be redirected towards savings or debt repayment.

- Build an Emergency Fund: Aim to save at least 3-6 months' worth of living expenses in an easily accessible savings account. This fund acts as a buffer against unexpected costs, preventing you from falling into deeper debt or becoming "Teongjang" when life throws a curveball.

- Educate Yourself: Continuously learn about personal finance. There are countless free resources online, from reputable financial blogs to government-backed financial literacy programs. Understanding concepts like interest, investments, and debt management can empower you to make better financial decisions.

Remember, financial wellness is a journey, not a destination. There will be ups and downs, but by implementing these practical steps, you can start to shift your narrative from the humorous despair of "Teongjang Jjal" to the empowering reality of financial stability.

The Future of Financial Memes: Teongjang Jjal and Beyond

The enduring popularity of "Teongjang Jjal" is a testament to the power of shared experience and humor in navigating life's challenges, especially financial ones. As long as people receive paychecks, spend money, and occasionally find their wallets looking a bit too thin, these memes will continue to resonate. The digital age, with its instant communication and viral trends, ensures that such relatable content finds its audience quickly and widely.

Looking ahead, the landscape of financial memes, including "Teongjang Jjal," is likely to evolve, mirroring changes in economic conditions, consumer behavior, and online platforms. We might see new variations emerge that reflect:

- Inflationary Pressures: Memes highlighting how quickly money loses its purchasing power.

- Gig Economy Challenges: Visuals depicting the unpredictability of income for freelancers or gig workers.

- Digital Currency Volatility: Humorous takes on the ups and downs of cryptocurrency investments.

- Sustainable Spending: Memes that subtly encourage conscious consumption over impulsive buying.

The conversation around money, once hushed, is becoming more open, thanks in part to phenomena like "Teongjang Jjal." These memes invite us to acknowledge our financial realities, laugh at them, and perhaps, take the first step towards a more secure financial future. So, the next time you see a "Teongjang Jjal," take a moment to chuckle, but also consider what it might be telling you about your own financial journey.

What are your favorite "Teongjang Jjal" moments? Share your thoughts and experiences in the comments below! And if you found this article insightful, don't hesitate to share it with friends who might also appreciate the humor and wisdom of the empty wallet meme. For more insights into cultural trends and practical tips, explore other articles on our site!

2030 통장 현재 상황 - 링커리어 커뮤니티

현재 통장 잔고 말하고 튀는 달글 - 인스티즈(instiz) 이슈 카테고리

언니이슈 | 이게 뭐야 ㅋㅋㅋㅋㅋ . . . . . . #애플 #계좌 #잔액 #텅장 #통장 #애플제품 #유머 #유머짤 #공감