Unlocking Opportunities: The Multifaceted Power Of Leverage Presents

In a world brimming with possibilities and challenges, understanding how to maximize potential is key to success. This is where the concept of "leverage presents" comes into play. Far from being a mere financial term, leverage, in its broadest sense, is about strategically utilizing available resources to achieve disproportionately larger outcomes. It's the art of doing more with less, amplifying effort, and transforming potential into tangible results. Whether you're navigating complex financial markets, building a thriving business, or even curating unforgettable social experiences, the principle of leverage is a powerful tool waiting to be understood and applied.

The term "leverage" itself carries a dynamic energy, suggesting the ability to move something heavy with minimal force. In various contexts, it implies a strategic advantage, a point of influence that, when properly engaged, can unlock significant opportunities. This article delves deep into the diverse applications of leverage, exploring its financial implications, its role in business and personal growth, and even its manifestation in the vibrant world of events. By grasping the core principles of how leverage presents itself, individuals and organizations can make more informed decisions, mitigate risks, and ultimately, achieve their goals with greater efficiency and impact.

Table of Contents

- Understanding Leverage: More Than Just Finance

- The Financial Facet of Leverage Presents

- Beyond Numbers: Leverage as a Strategic Advantage

- Navigating the Risks: When Leverage Presents Challenges

- Leverage Presents in Real-World Scenarios: Events & Experiences

- Real Estate and Market Dynamics: Leverage for Buyers

- The Core of Success: Benchmarking and Backbone in Leverage

- Maximizing Your Leverage: A Path to Greater Returns

Understanding Leverage: More Than Just Finance

At its heart, leverage is about effective utilization. When we speak of "use," "utilize," "employ," "leverage," "apply," "avail," or "exploit" as verbs, they all convey the meaning of "to use" or "to apply." However, in English writing, "use," "employ," and "leverage" are particularly common when expressing this concept. While "use" is a general term focusing on achieving a specific purpose, "leverage" carries a stronger connotation of strategic advantage and amplified impact. It suggests harnessing a small input to generate a much larger output. This can be seen in various aspects of life, from physical mechanics to complex financial strategies.

The power of leverage lies in its ability to magnify. Imagine a simple lever: a small force applied at one end can lift a much heavier object at the other. This mechanical principle translates seamlessly into other domains. In business, it could mean using a small marketing budget to generate widespread brand awareness, or a startup using innovative technology to disrupt an established industry. The core idea is to identify and capitalize on points of influence that allow for significant returns on relatively modest investments of time, effort, or capital. This foundational understanding is crucial before delving into its more specialized applications.

The Financial Facet of Leverage Presents

When discussing "leverage presents" in a financial context, the term "Financial leverage ratio," also known as "Long-term Solvency Measures," immediately comes to mind. This ratio refers to the practice of using borrowed funds—our debt—to acquire other assets. The fundamental expectation is that the income generated from these newly acquired assets will significantly exceed the cost of borrowing. This strategy is a double-edged sword: while it offers the potential for amplified returns, it also introduces magnified risks. If the new assets do not perform as expected, the borrowing party faces the burden of debt without the corresponding income to offset it.

For instance, a company might take out a loan to invest in new machinery. If this machinery boosts production and sales dramatically, the company's net profit could see a substantial increase, far outweighing the interest paid on the loan. This is a successful application of financial leverage. However, if the market for their product shrinks, or the machinery breaks down frequently, the company could struggle to repay the loan, potentially leading to financial distress. This inherent risk makes careful analysis and management of financial leverage paramount for any entity looking to grow through borrowed capital.

Decoding Financial Leverage Ratios

In financial analysis, we frequently encounter situations where a company's operating performance might seem steady, yet suddenly, over a few years, its net profit surges despite only modest revenue growth. This often signals the effective (or sometimes risky) use of financial leverage. Financial leverage ratios provide insights into how much debt a company is using to finance its assets and operations. These measures help analysts and investors understand a company's ability to meet its long-term obligations and its reliance on borrowed capital. Common ratios include the Debt-to-Equity Ratio, Debt-to-Asset Ratio, and Interest Coverage Ratio.

By interpreting these ratios, one can gauge the extent to which a company is "leveraged." A high financial leverage ratio indicates a greater reliance on debt, which can boost returns during good times but amplify losses during downturns. Conversely, a low ratio suggests a more conservative approach, with less reliance on external financing. Understanding these nuances is crucial for stakeholders, as it sheds light on the company's financial risk profile and its potential for future growth or vulnerability. It's not just about the numbers themselves, but what they reveal about the company's strategic financial decisions.

Beyond Numbers: Leverage as a Strategic Advantage

The concept of leverage extends far beyond financial statements. As the adage goes, "Leverage = People + Capital + Intellectual Property." To truly build wealth and achieve significant outcomes, one must learn to utilize the "leverage effect" to amplify the results of their limited time and labor. This perspective highlights three fundamental types of business leverage: human capital, financial capital, and intellectual property. Each offers a unique pathway to magnify efforts and create exponential growth, rather than merely linear progression.

Consider the difference between a sole proprietor working endless hours and a business owner who has successfully leveraged these three elements. The sole proprietor is limited by their own time and energy. The business owner, however, employs people, invests capital, and develops unique intellectual property, allowing their business to generate value far beyond what any single individual could achieve. This strategic application of leverage is what separates mere activity from scalable, impactful success.

Human Capital: The Oldest Form of Leverage

Human capital is arguably the most ancient form of leverage. From the earliest communal efforts to modern corporations, people have combined their skills and labor to achieve goals impossible for an individual. Employing others allows a business owner to multiply their output, delegate tasks, and specialize functions, leading to greater efficiency and capacity. A single entrepreneur can only accomplish so much; with a team, the collective output can be immense. This is why building a strong team, empowering employees, and fostering a productive work environment are crucial for any organization seeking to scale.

However, leveraging human capital isn't just about hiring more people. It's about optimizing their skills, providing the right tools, and creating systems that enable them to perform at their best. It's about leadership that inspires and directs, ensuring that individual efforts coalesce into a powerful, unified force. The ability to effectively manage and motivate human resources is a powerful form of leverage that directly impacts a company's productivity, innovation, and overall success.

Intellectual Property: The Modern Multiplier

In the digital age, intellectual property (IP) has emerged as an incredibly potent form of leverage. This includes patents, copyrights, trademarks, software, unique processes, and even proprietary data. Unlike human labor, which is limited by time, or capital, which can be depleted, intellectual property, once created, can be replicated, licensed, and utilized almost infinitely at minimal additional cost. Think of a software company that develops a single program: it can be sold to millions of users without significant additional production costs per unit.

This makes intellectual property a powerful engine for wealth creation and market dominance. Companies that successfully develop and protect their IP can generate recurring revenue streams, build competitive moats, and achieve disproportionate returns on their initial investment. This form of leverage allows businesses to scale rapidly and efficiently, reaching a global audience with products or services that embody unique knowledge or creative output. It represents a shift from physical production to the creation and dissemination of information and innovation.

Navigating the Risks: When Leverage Presents Challenges

While the potential rewards of leverage are significant, it is critical to understand that "leverage presents opportunities for increasing both returns and losses because any event which affects the value of an investment is magnified to the extent leverage is employed." This inherent duality means that leveraging strategies, particularly in finance, must be approached with caution and a thorough understanding of potential downsides. A small negative shift in market conditions or asset performance can lead to disproportionately large losses when leverage is involved.

Consider the analogy of "studentized residuals vs. leverage" plots in R software, used for analyzing regression models. The red lines often seen on such plots (e.g., at 0.5 or 1) indicate thresholds for outliers or influential data points. Similarly, in real-world leverage, there are thresholds beyond which risks become unmanageable. Over-leveraging, or failing to account for unforeseen variables, can lead to severe financial distress or business failure. This is why rigorous analysis, scenario planning, and risk mitigation strategies are essential when employing any form of leverage. It's about understanding not just the potential upside, but the magnified downside, and having contingencies in place.

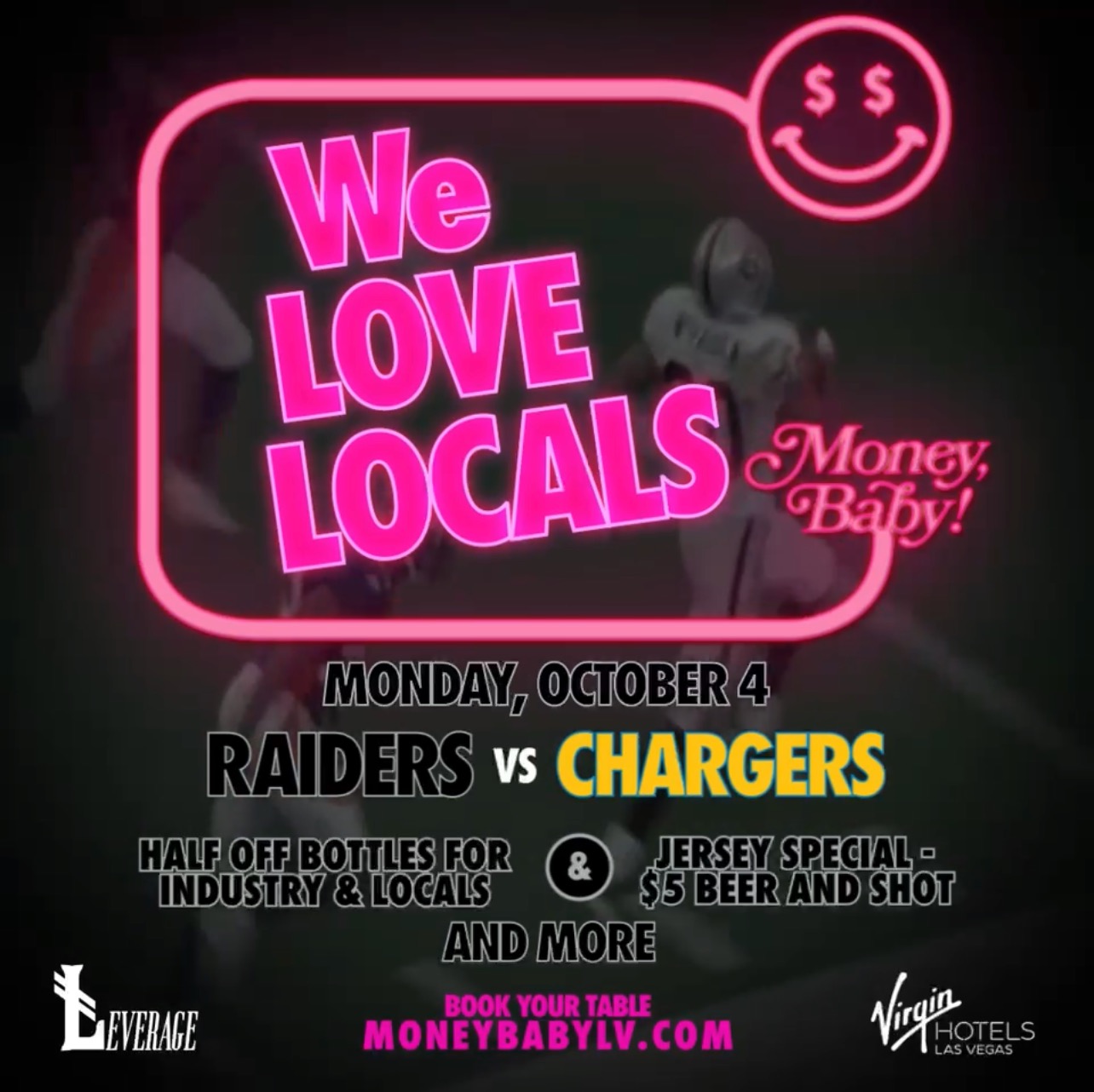

Leverage Presents in Real-World Scenarios: Events & Experiences

Beyond finance and business strategy, the term "leverage presents" also takes on a more direct, experiential meaning, particularly in the entertainment and event industry. We see this with phrases like "Leverage presents properties from leading agents and brokerages worldwide" or "Get tickets for Leverage Presents, the hottest R&B party at Varsity Theater." Here, "leverage presents" acts as a brand, a curator, or a promoter, using its influence, network, and expertise to bring forth desirable opportunities or experiences to an audience. It's about leveraging a reputation, a venue, or a specific niche to attract a crowd.

For example, "The Rendezvous at LIV in Las Vegas, located at the iconic Fontainebleau Las Vegas," signifies an event where the "Leverage Presents" brand is utilizing the prestige of a well-known venue to elevate the event's appeal. The promise of "a night like no other" is a direct result of leveraging the venue's reputation and the promoter's ability to curate an attractive experience. This application of "leverage presents" is less about financial ratios and more about brand power, network effects, and the ability to connect supply (artists, venues) with demand (the audience).

Curating Unforgettable Moments: The "Leverage Presents" Experience

The event industry thrives on the ability to create unique and memorable experiences, and "leverage presents" plays a crucial role in this. Events like "Simp City, the hottest R&B party from Las Vegas, originating from the hottest house parties now making waves on the grandest stages of Vegas!" exemplify how a successful concept can be leveraged from smaller beginnings to larger platforms. The brand "Leverage Presents" acts as the backbone, the core entity that facilitates these transitions and brings these experiences to a wider audience.

For attendees, the ease of access—"Simply click the above buttons for table reservations, tickets, or guest list access"—is part of the leveraged experience. The promise of an event for those who "like R&B, Hip Hop, Rap, New West Coast sounds, and everything in between" showcases how "Leverage Presents" understands and caters to specific audience preferences, building on a proven formula. Even the rising ticket prices as an event approaches indicate the leverage of demand over supply, a direct outcome of successful promotion and perceived value. It's about creating an irresistible offering by leveraging established appeal and effective marketing.

Real Estate and Market Dynamics: Leverage for Buyers

In the real estate market, the concept of "leverage presents" often shifts to the advantage of the buyer, particularly when inventory trends suggest a surplus. "Yet, for buyers, this abundance of choice and leverage presents an opportunity to secure a home at favorable, even aggressive terms, as inventory trends suggest further." In such a market, buyers have more negotiating power because sellers are competing for a smaller pool of interested parties. This creates a scenario where buyers can "leverage" the market conditions to their benefit, pushing for lower prices, better terms, or additional concessions.

This buyer's leverage is a direct result of supply and demand dynamics. When there are more homes on the market than there are active buyers, the balance of power shifts. Buyers can take their time, compare multiple options, and make offers that might have been considered "aggressive" in a seller's market. This is a prime example of how external market conditions can create leverage points, allowing one party in a transaction to achieve more favorable outcomes through strategic negotiation and patience.

The Core of Success: Benchmarking and Backbone in Leverage

Underlying any successful application of leverage is a strong "backbone"—the core, the foundational pillar that supports the entire structure. Just as the human spine provides essential support, a robust strategy, a solid financial base, or a strong brand reputation forms the backbone of effective leverage. In the context of "Leverage Presents properties from leading agents and brokerages worldwide," the network of trusted partners and the brand's credibility serve as its backbone, enabling it to offer premium real estate.

Furthermore, "benchmarking measures performance using a specific indicator, resulting in a metric that is then compared to others." This principle, commonly applied in machine learning, is equally vital when leveraging. To know if your leverage strategy is working, you need to measure its performance against established benchmarks or key performance indicators (KPIs). This allows for continuous evaluation and adjustment, ensuring that the leveraged efforts are indeed yielding the desired results and not just consuming resources. Without a clear backbone and consistent benchmarking, any attempt to leverage can quickly become unstable and ineffective.

Maximizing Your Leverage: A Path to Greater Returns

The journey through the diverse applications of "leverage presents" reveals a powerful truth: whether in finance, business, or even event curation, the strategic application of resources can yield extraordinary results. From the careful deployment of borrowed capital to the ingenious use of human talent and intellectual property, leverage is the force that amplifies limited inputs into significant outputs. It is the reason why some enterprises grow exponentially while others remain stagnant, why some investments generate outsized returns, and why certain events become iconic.

However, the recurring theme is the dual nature of leverage: it magnifies both gains and losses. This underscores the critical importance of expertise, careful planning, and continuous monitoring. Successful leveraging is not about reckless risk-taking, but about calculated strategy, informed by data and a deep understanding of the underlying dynamics. As the earliest life cycle phases of a project have the most leverage over its total cost, early conceptual design plays a central role in long-term success. This principle applies broadly: the earlier you identify and apply leverage points, the greater your potential impact. Embrace the power of leverage, but do so with wisdom and foresight, and you will unlock a path to greater returns and unparalleled opportunities.

What aspects of leverage resonate most with your experiences? Share your thoughts in the comments below, or explore our other articles on strategic growth and financial empowerment to continue your journey of understanding and maximizing your potential.

Leverage Presents: The Rendezvous at LIV - Fontainebleau Las Vegas

Leverage Events | Hottest Music Events in Las Vegas

Leverage Events | Hottest Music Events in Las Vegas