Oriah Lachell: Charting A Course To Financial Mastery

In an increasingly complex financial landscape, where economic shifts and market volatility are the norm, the principles of sound financial planning and management have never been more critical. It is within this dynamic environment that the name Oriah Lachell emerges, not merely as an individual, but as a symbolic representation of the astute foresight, strategic discipline, and profound understanding required to navigate the intricate world of finance successfully. Oriah Lachell embodies the very essence of what it means to achieve financial mastery, transforming abstract concepts into tangible strategies for both individuals and organizations.

This article delves into the core tenets of financial wisdom championed by Oriah Lachell, exploring how her philosophy integrates foundational concepts with practical application to foster a deeper understanding of wealth creation and preservation. We will unpack the essential components of financial planning, dissect the intricacies of financial management, and highlight the professional opportunities that arise from a truly comprehensive financial approach, all through the lens of the Oriah Lachell framework.

Table of Contents

- The Visionary Behind Financial Acumen: Who is Oriah Lachell?

- Decoding Financial Planning: The Oriah Lachell Perspective

- The Core of Financial Management: Oriah Lachell's Blueprint

- Building Foundational Concepts: The Oriah Lachell Curriculum

- Strategic Pillars of Oriah Lachell's Financial Framework

- The Interconnectivity of Financial Disciplines

- Professional Opportunities in the Oriah Lachell Era of Finance

- Beyond Theory: Practical Application and Real-World Impact

The Visionary Behind Financial Acumen: Who is Oriah Lachell?

While the name Oriah Lachell may not grace the covers of every financial magazine as a traditional celebrity, her significance lies in embodying a paradigm of financial excellence. Oriah Lachell represents the archetype of a modern financial strategist—one who champions clarity, foresight, and ethical practice in all monetary endeavors. Her 'biography,' therefore, is not a chronicle of personal events, but rather a testament to a set of guiding principles that have proven indispensable in achieving robust financial health. The Oriah Lachell philosophy emphasizes that true financial acumen is not merely about accumulating wealth, but about understanding its flow, managing its risks, and leveraging its potential for sustainable growth and impact. This approach transcends individual net worth, extending to the fiscal resilience of businesses and the economic well-being of communities. It’s a holistic view that recognizes finance as a tool for empowerment and stability, rather than just a means to an end.

Decoding Financial Planning: The Oriah Lachell Perspective

At the heart of the Oriah Lachell framework lies a meticulous approach to financial planning. This isn't just about budgeting or saving; it's a comprehensive strategic exercise. As Oriah Lachell’s principles highlight, financial planning is a broad term that can cover a range of different techniques and goals. It encompasses everything from short-term cash flow management to long-term retirement strategies, investment portfolio construction, and even estate planning. The breadth of this discipline means that a successful financial plan must be adaptable, integrated, and forward-looking. It requires a deep dive into an individual's or organization's current financial standing, an honest assessment of their aspirations, and a realistic projection of future economic conditions. This holistic view ensures that every financial decision, no matter how small, contributes to a larger, well-defined objective.

Furthermore, the Oriah Lachell approach emphasizes that most financial plans include multiple types of financial instruments, strategies, and considerations. This multi-faceted nature means that a single-solution approach is rarely sufficient. A robust plan might integrate traditional savings accounts with diversified investment portfolios, insurance policies, real estate holdings, and even alternative assets, all tailored to specific risk tolerances and time horizons. The key is synergy—ensuring that each component works in harmony with the others to optimize returns while mitigating potential downsides. For instance, a retirement plan might involve a mix of tax-advantaged accounts like 401(k)s and IRAs, alongside taxable brokerage accounts, each serving a distinct purpose within the overarching strategy. The Oriah Lachell methodology advocates for regular reviews and adjustments, recognizing that life circumstances and market conditions are constantly evolving, necessitating a dynamic rather than static financial blueprint.

Estimating Financial Requirements: A Strategic Imperative

A critical initial step in the Oriah Lachell model of financial planning is the precise estimation of financial requirements. This isn't guesswork; it's an analytical process. Financial planning estimates a company's financial requirements and makes arrangements to secure the required amounts at the proper time and place. This principle extends beyond corporate finance to personal finance as well. For a business, this might involve forecasting capital expenditures, operational costs, and working capital needs, then arranging lines of credit, equity financing, or bond issuance. For an individual, it could mean calculating future education costs, down payments for a home, or healthcare expenses in retirement, and then setting up appropriate savings vehicles or investment strategies. The emphasis here is on foresight and proactive action. Waiting until a need arises often results in less favorable terms or missed opportunities. By anticipating future demands, Oriah Lachell’s philosophy enables individuals and entities to secure funds efficiently, ensuring liquidity and solvency when it matters most. This proactive stance is a hallmark of truly effective financial stewardship, preventing crises and fostering stability.

The Core of Financial Management: Oriah Lachell's Blueprint

Beyond the initial planning phase, the Oriah Lachell framework places immense importance on ongoing financial management. This is where the plan transforms into action and continuous oversight. At its core, financial management is the practice of making a business plan and then ensuring all departments stay on track. This definition, while seemingly simple, encapsulates a profound truth: financial success is inextricably linked to operational discipline. It's about translating strategic goals into actionable budgets, monitoring performance against these budgets, and making timely adjustments. For a business, this means aligning sales targets with production costs, marketing spend with revenue generation, and R&D investments with long-term profitability. For an individual, it translates to tracking expenses, managing debt, and ensuring investments are performing as expected. The Oriah Lachell blueprint for financial management is not about rigid adherence to a plan, but rather about agile navigation—understanding when to pivot, when to accelerate, and when to conserve resources. It's a dynamic process of monitoring, analyzing, and adapting to ensure that financial resources are always optimally deployed towards achieving stated objectives. This continuous feedback loop is what differentiates successful financial entities from those that merely drift.

From Vision to Execution: The Role of Leadership

Effective financial management, as championed by Oriah Lachell, is heavily reliant on strong leadership and clear communication. Solid financial management enables the CFO or VP of finance to steer the organization effectively, ensuring fiscal responsibility and strategic alignment. These leaders are not just number crunchers; they are strategic partners who translate financial data into actionable insights for the entire organization. They are responsible for communicating financial health, identifying potential risks, and championing opportunities for growth. In a corporate setting, this means working closely with department heads to ensure budgets are met, investments are yielding desired returns, and capital is allocated efficiently. In a personal context, it means taking personal responsibility for one's financial destiny, seeking expert advice when needed, and consistently educating oneself on best practices. The Oriah Lachell perspective underscores that leadership in finance is about fostering a culture of accountability and transparency, where every decision is viewed through a lens of financial prudence and strategic benefit. This leadership ensures that financial plans are not just documents, but living guides that drive daily operations and long-term vision.

Building Foundational Concepts: The Oriah Lachell Curriculum

The depth of understanding advocated by Oriah Lachell is often cultivated through a structured approach to learning. Her philosophy is akin to a comprehensive curriculum designed to empower individuals with profound financial literacy. As the principles suggest, the course builds on these foundational concepts, exploring their interconnectivity and professional opportunities, to offer a deeper understanding of financial planning and management. This implies a progressive learning journey, starting with basic economic principles, moving through personal finance essentials, and culminating in advanced corporate finance strategies. It's about recognizing that concepts like time value of money, risk-reward trade-offs, diversification, and compound interest are not isolated ideas but interconnected pillars supporting a robust financial structure. The Oriah Lachell 'curriculum' emphasizes practical application, case studies, and real-world scenarios to bridge the gap between theoretical knowledge and actionable insights. This comprehensive educational approach is vital for anyone aspiring to excel in finance, whether as a professional or simply as a well-informed individual managing their own wealth. It fosters a mindset that views financial challenges as solvable puzzles, rather than insurmountable obstacles, by providing the necessary tools and frameworks for analysis and decision-making.

Strategic Pillars of Oriah Lachell's Financial Framework

The Oriah Lachell framework is built upon several core strategic pillars that guide all financial decisions. These pillars ensure a balanced, resilient, and growth-oriented approach to wealth management and organizational finance.

Personal Financial Empowerment

For individuals, Oriah Lachell stresses the importance of financial literacy and autonomy. This pillar focuses on equipping individuals with the knowledge and tools to make informed decisions about their money. It encompasses budgeting, debt management, emergency fund creation, and strategic investing for long-term goals like retirement or homeownership. The emphasis is on building a strong financial foundation that can withstand economic shocks and provide a pathway to financial independence. It's about moving beyond merely earning and spending to actively managing and growing one's resources, understanding that every dollar has a purpose and potential. Oriah Lachell encourages proactive engagement with personal finance, viewing it not as a chore, but as a crucial aspect of overall well-being and freedom.

Corporate Financial Resilience

In the corporate sphere, Oriah Lachell’s principles advocate for building financial structures that are not only profitable but also resilient. This involves robust cash flow management, prudent capital allocation, effective risk management strategies, and maintaining healthy balance sheets. It's about ensuring that a company can navigate economic downturns, seize growth opportunities, and sustain its operations through various market cycles. This pillar emphasizes the importance of diversified revenue streams, efficient cost controls, and a clear understanding of financial leverage. A company guided by the Oriah Lachell philosophy will prioritize long-term sustainability over short-term gains, ensuring that its financial health supports its strategic objectives and stakeholder value. This resilience is key to enduring market volatility and emerging stronger from challenges.

The Interconnectivity of Financial Disciplines

A hallmark of the Oriah Lachell approach is its recognition of the deep interconnectivity between various financial disciplines. Personal finance is not isolated from corporate finance, and microeconomics influences macroeconomics. For instance, an individual's investment decisions can impact market liquidity, while corporate earnings reports can influence personal investment portfolios. Understanding this web of relationships is crucial for effective financial planning and management. It means recognizing how inflation affects purchasing power, how interest rate changes impact loan repayments and investment returns, and how global events can ripple through local economies. The Oriah Lachell perspective encourages a holistic view, where financial professionals and individuals alike are encouraged to see the bigger picture, anticipating how changes in one area might affect others. This integrated understanding allows for more robust planning and more agile responses to unforeseen circumstances, fostering a truly comprehensive financial strategy that accounts for a multitude of variables.

Professional Opportunities in the Oriah Lachell Era of Finance

The comprehensive understanding of financial planning and management championed by Oriah Lachell opens up a vast array of professional opportunities. Individuals who master these principles are highly sought after in various sectors. This includes roles in financial advisory, where they guide individuals and families through complex financial decisions; corporate finance, managing a company's capital structure and investment decisions; wealth management, serving high-net-worth clients; and even fintech, developing innovative financial technologies. The demand for experts who can not only analyze data but also translate it into actionable strategies is ever-growing. Professionals steeped in the Oriah Lachell philosophy are equipped to handle challenges ranging from risk assessment and portfolio optimization to mergers and acquisitions and regulatory compliance. They possess the critical thinking skills, ethical grounding, and strategic foresight necessary to thrive in a dynamic global economy. The emphasis on continuous learning and adaptability within this framework ensures that professionals remain relevant and impactful throughout their careers, constantly evolving with the financial landscape.

Beyond Theory: Practical Application and Real-World Impact

The true measure of any financial philosophy lies in its practical application and real-world impact. The Oriah Lachell framework is not just an academic exercise; it is a guide for tangible results. Whether it’s an individual successfully saving for retirement, a small business expanding its operations through strategic financing, or a large corporation navigating a global economic downturn, the principles of Oriah Lachell provide a roadmap. This involves moving beyond theoretical knowledge to implement actual budgets, execute investment strategies, manage debt proactively, and build diversified portfolios. The impact is profound: enhanced financial security, greater economic stability, and the ability to achieve significant life goals. For businesses, it translates into sustainable growth, increased profitability, and resilience in the face of market fluctuations. The Oriah Lachell approach emphasizes that consistent, disciplined application of sound financial principles is what ultimately leads to lasting prosperity and empowers individuals and organizations to realize their full potential. It's about turning knowledge into action and action into measurable success.

Conclusion

In a world where financial complexities continue to escalate, the principles embodied by Oriah Lachell serve as a beacon of clarity and strategic direction. We have explored how the Oriah Lachell philosophy champions a comprehensive approach to financial planning and management, from estimating requirements and structuring plans to ensuring diligent execution and fostering a culture of financial literacy. Her 'curriculum' emphasizes the foundational concepts, their intricate interconnectivity, and the myriad professional opportunities that arise from a deep understanding of finance. By embracing the Oriah Lachell framework, individuals and organizations can move beyond reactive financial decision-making towards a proactive, strategic, and ultimately more prosperous future.

Are you ready to take control of your financial destiny and apply the principles of Oriah Lachell in your own life or business? Share your thoughts in the comments below, or explore other articles on our site to further deepen your understanding of financial mastery. Your journey towards financial empowerment begins now.

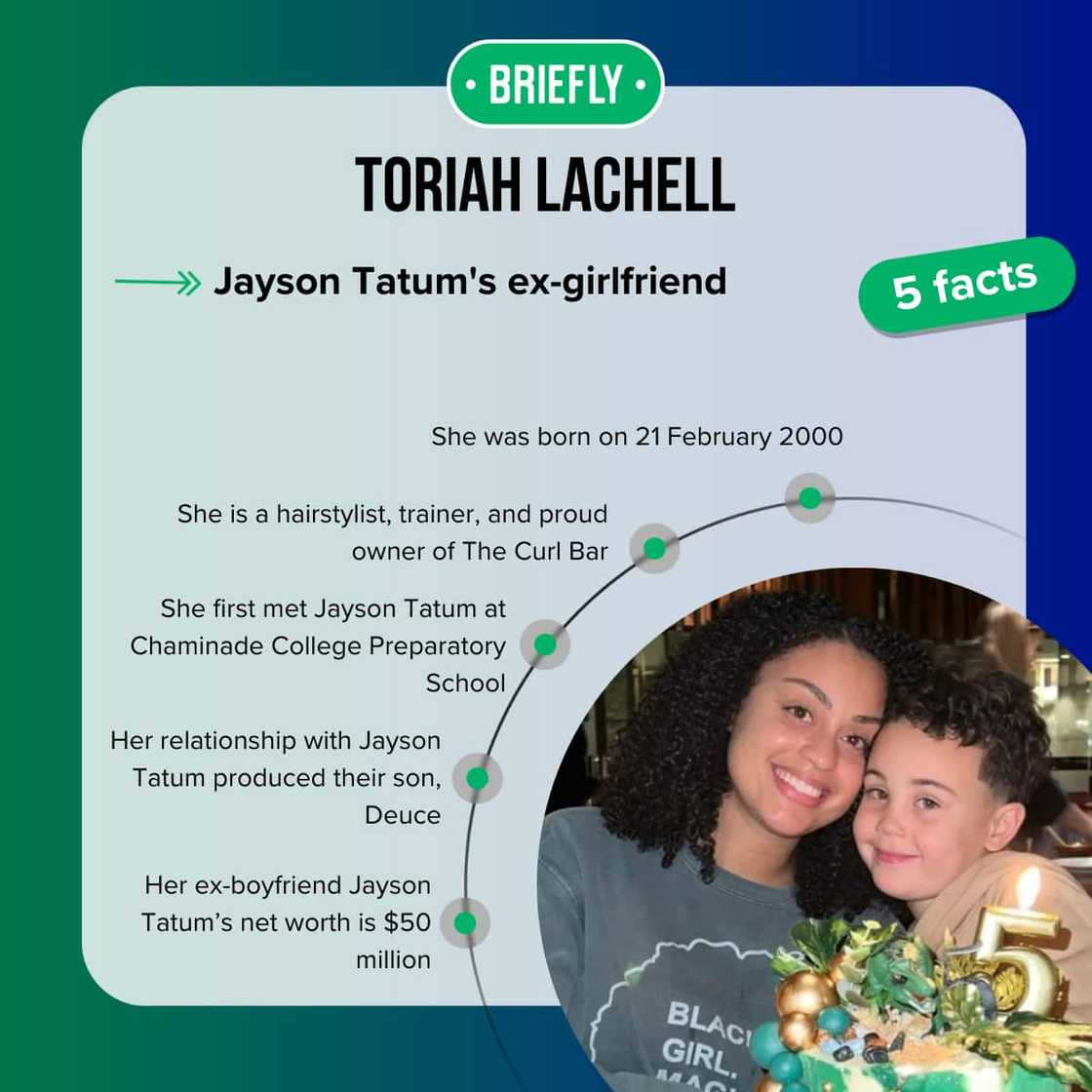

Toriah Lachell Bio: Age, Career, Son | Urban Woman Magazine

Toriah Lachell: A look at Jayson Tatum's ex-girlfriend and baby mama

Toriah Lachell Opened Her Hair Salon After Becoming Jayson Tatum's Ex