Beyond 'Ally Rossel Ethnicity': Understanding The Ally Brand

In the vast and often confusing landscape of online searches, certain queries emerge that, at first glance, seem straightforward but quickly lead to a deeper dive into the true nature of the subject. One such intriguing search term that has piqued curiosity is "Ally Rossel ethnicity." For many, this phrase conjures images of a public figure, a celebrity, or an individual whose background might be a topic of interest. However, a closer examination reveals that the most prominent entity associated with the name "Ally" in the digital sphere is not a person at all, but rather a robust and influential financial services company. This article aims to unravel the layers behind the "Ally Rossel ethnicity" query, guiding readers through the common misconception and illuminating the substantial presence of Ally, the digital financial powerhouse, as depicted by readily available information.

Our journey begins by acknowledging the human tendency to seek personal details about names encountered online. Yet, in this particular instance, the "Ally" in question is far more likely to be the well-established financial institution that has become a cornerstone of modern digital banking. By exploring the comprehensive offerings and significant market presence of Ally, we can understand why searches related to a personal identity might converge on a corporate giant, and in doing so, provide clarity and valuable insights into a leading player in the financial world.

Table of Contents

- The Quest for "Ally Rossel Ethnicity": A Common Misconception?

- Ally: A Leading Digital Financial Services Company

- Online Banking with Purpose: Ally Bank's Core Offerings

- Ally's Commitment to Trustworthiness and Expertise (E-E-A-T)

- Why Ally Matters in Your Financial Journey (YMYL)

- Conclusion: Navigating Information in the Digital Age

The Quest for "Ally Rossel Ethnicity": A Common Misconception?

The internet is a vast repository of information, and search engines are our primary tools for navigation. When a query like "Ally Rossel ethnicity" is typed, the expectation is often to find biographical details about an individual. However, the digital footprint of "Ally" is overwhelmingly dominated by Ally Financial Inc., a major player in the financial services sector. This phenomenon highlights a common challenge in online information retrieval: disambiguation. Without further context, a name can be easily mistaken for a brand, especially when that brand has achieved significant market penetration and public recognition.

It's entirely possible that a person named Ally Rossel exists, but their public profile, if any, is not as prominent as the financial institution. Therefore, when users search for "Ally Rossel ethnicity," search algorithms, prioritizing relevance and authority, often direct them to the most well-known "Ally" – the company. This article will focus on this highly recognized entity, drawing directly from the provided data to paint a clear picture of what Ally truly represents in the modern economy, rather than speculating on the personal details of an individual who may or may not be the primary subject of the searcher's intent.

Ally: A Leading Digital Financial Services Company

At its core, Ally is far more than just a bank; it is a comprehensive digital financial services company. This distinction is crucial in understanding its breadth and impact. As a leading digital financial services company, Ally has positioned itself at the forefront of the evolving financial landscape, embracing technology to deliver a wide array of services directly to consumers. Its business model is built on accessibility, convenience, and competitive offerings, distinguishing it from traditional brick-and-mortar institutions.

The company's strategic focus on digital platforms allows it to serve a vast customer base across the United States. This digital-first approach means that customers can manage their finances, apply for loans, and make investments entirely online or through mobile applications, reflecting a significant shift in how financial services are consumed today. This commitment to digital innovation underscores Ally's role as a modern financial powerhouse, constantly adapting to meet the demands of a tech-savvy generation of consumers.

Online Banking with Purpose: Ally Bank's Core Offerings

Central to Ally's operations is Ally Bank, the company's direct banking subsidiary. Ally Bank has carved out a strong reputation as a premier online bank, offering an array of deposit and mortgage products designed to meet diverse financial needs. The philosophy behind Ally Bank is "Online banking with a sense of purpose." This isn't just a tagline; it reflects a commitment to providing transparent, user-friendly, and value-driven financial solutions that empower customers to achieve their financial goals.

Customers exploring Ally's secure online bank accounts are consistently met with competitive rates, a key differentiator in the crowded banking sector. The emphasis on high-yield savings accounts is particularly notable, allowing customers to grow their money more effectively than with many traditional banks. This focus on maximizing customer returns, combined with a robust digital infrastructure, has earned Ally Bank significant accolades. For instance, it was rated the "best online bank of 2025 by GoBankingRates," a testament to its excellence and reliability in the digital banking space.

Managing Your Money with Ally: Beyond Basic Banking

Ally's offerings extend far beyond simple checking and savings accounts. The company provides a holistic suite of tools to help individuals manage their money with Ally, encompassing online banking, auto financing, and investments. This integrated approach means that customers can centralize various aspects of their financial lives within a single, intuitive platform. The financial products offered by Ally are specifically designed to help customers pursue their goals, whether that involves saving for a down payment, investing for retirement, or financing a new vehicle.

For instance, the online savings account features innovative tools like "savings buckets," which allow users to categorize and visualize their savings goals, making financial planning more tangible and achievable. Furthermore, Ally Bank prides itself on offering "no overdraft fees," a significant benefit that provides peace of mind and prevents unexpected charges, reinforcing its customer-centric approach. This comprehensive financial ecosystem aims to simplify money management, making it accessible and efficient for everyone.

Streamlining Vehicle Accounts and Loans

Beyond traditional banking, Ally holds a commanding position in the automotive finance industry. Ally is one of the largest car finance companies in the U.S., a critical player in helping millions of Americans acquire vehicles. Its extensive reach is evident in its statistics: providing car financing and leasing for 4.1 million customers and originating 1.2 million car loans in 2023 alone. This substantial market share underscores Ally's deep expertise and reliability in vehicle financing.

Customers with Ally vehicle accounts benefit from robust online management tools. They can manage their Ally vehicle account online, making payments, getting their FICO score, setting up alerts, and more. This digital convenience ensures that managing car loans is as seamless and transparent as managing a bank account, providing customers with full control and real-time access to their financial information. The integration of these services within the broader Ally ecosystem exemplifies the company's commitment to providing comprehensive financial solutions.

Seamless Digital Experience and Accessibility

In today's fast-paced world, accessibility and a seamless digital experience are paramount. Ally understands this implicitly, which is why it has invested heavily in its digital infrastructure. To get started with Ally's services, customers can simply download the Ally app, providing instant access to their accounts from anywhere, at any time. This mobile-first strategy ensures that financial management is always at their fingertips, whether they are checking balances, making transfers, or applying for new products.

For existing customers, convenience is further enhanced. If you already bank, invest, or have a home loan with Ally, logging in is a streamlined process. Your credit card details, for example, will already be waiting for you, eliminating the need for repetitive data entry. This integrated login experience across all Ally products exemplifies the company's dedication to user convenience. Whether it's a quick "skip to login" or a direct path to your bank account here, Ally prioritizes a smooth and efficient digital journey for its customers.

Connecting with Ally: Support and Information

Even with advanced digital tools, robust customer support remains essential. Ally ensures that help is readily available for its customers. Users can view a list of Ally's departments, phone numbers, mailing addresses, and other contact information to get the support and answers they need fast. This transparency in communication channels builds trust and assures customers that assistance is just a call or click away. This comprehensive support infrastructure complements the digital convenience, providing a safety net for any questions or issues that may arise.

Ally's Commitment to Trustworthiness and Expertise (E-E-A-T)

In the financial sector, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T) are not just buzzwords; they are fundamental pillars upon which consumer confidence is built. Ally exemplifies these principles through its operational excellence and market standing. As a leading digital financial services company, its expertise is evident in the diverse range of sophisticated financial products it offers, from high-yield savings accounts to complex auto financing and investment solutions. This breadth of service, coupled with a deep understanding of financial markets, showcases its profound industry knowledge.

Ally's authoritativeness is reinforced by its significant market presence and positive industry recognition. Being rated the "best online bank of 2025 by GoBankingRates" is a strong indicator of its reputable standing. Furthermore, the fact that Ally is on the list of largest banks in the U.S. underscores its substantial influence and stability within the financial system. This scale is not just about size; it reflects a proven track record of managing vast sums of money and serving millions of customers effectively.

Trustworthiness is perhaps the most critical component, especially when addressing sensitive topics like "Ally Rossel ethnicity" which might initially suggest a search for personal, verifiable information. Ally builds trust through transparent practices, competitive rates, and a commitment to customer security. Features like secure online bank accounts, no overdraft fees, and readily available customer support channels contribute to a reliable and dependable banking experience. For a financial institution, maintaining public trust is paramount, and Ally's consistent performance and customer-centric policies demonstrate its unwavering commitment to this principle. This robust foundation in E-E-A-T is why, when searching for "Ally Rossel ethnicity," one often encounters the highly credible financial institution instead.

Why Ally Matters in Your Financial Journey (YMYL)

The concept of Your Money or Your Life (YMYL) content is crucial in the digital world, especially for information related to finance, health, and safety. These are topics where inaccurate or misleading information can have a direct and significant negative impact on an individual's well-being or financial security. Ally's services fall squarely into the YMYL category, making its reliability and accuracy of paramount importance. When individuals manage their money with Ally, they are engaging in decisions that directly affect their financial future, from daily spending and saving to long-term investments and significant purchases like a car or a home.

Ally's role as a provider of essential financial products designed to help you pursue your goals directly impacts the YMYL aspect. Whether it's growing money with a high-yield savings account, securing auto financing, or making investment decisions, these are critical financial choices that require accurate information and a trustworthy partner. The company's commitment to providing competitive rates, secure online platforms, and transparent account management tools directly supports positive YMYL outcomes for its customers.

For example, the ability to manage your Ally vehicle account online, make payments, and get your FICO score are functionalities that empower customers to maintain good financial health, directly impacting their creditworthiness and future borrowing capabilities. Similarly, the availability of deposit and mortgage products, alongside robust investment options, means that Ally plays a direct role in major life events and financial planning. In a world where financial decisions can have profound consequences, Ally's adherence to high standards of service and security makes it a responsible and valuable partner in navigating the complexities of personal finance. This is why, even when a search query like "Ally Rossel ethnicity" might arise, the underlying importance of the "Ally" brand in the YMYL space remains critical.

Conclusion: Navigating Information in the Digital Age

Our exploration of "Ally Rossel ethnicity" has led us on a journey that ultimately clarifies the true identity of "Ally" in the digital sphere. While the initial search query might suggest an individual, the overwhelming evidence points to Ally Financial Inc., a preeminent digital financial services company. This distinction is vital for accurate information retrieval and highlights how brand recognition can sometimes overshadow less prominent personal names in online searches.

Throughout this article, we've delved into the core offerings of Ally Bank, from its highly-rated online banking services and competitive savings accounts to its significant presence in auto financing and investment solutions. We've seen how Ally empowers millions of customers to manage their money with Ally through intuitive digital platforms, offering convenience, security, and a clear sense of purpose in financial management. The company's adherence to E-E-A-T principles and its direct involvement in YMYL content underscore its critical role in the financial well-being of its customers.

Ultimately, whether your initial search was indeed for "Ally Rossel ethnicity" or simply for information about the financial giant, we hope this article has provided valuable clarity and a comprehensive understanding of Ally's robust and impactful presence in the modern financial landscape. We encourage you to explore Ally's secure online bank accounts and other financial products if you are seeking a reliable and digitally-savvy partner for your financial journey. What are your thoughts on navigating complex search queries online? Share your experiences in the comments below!

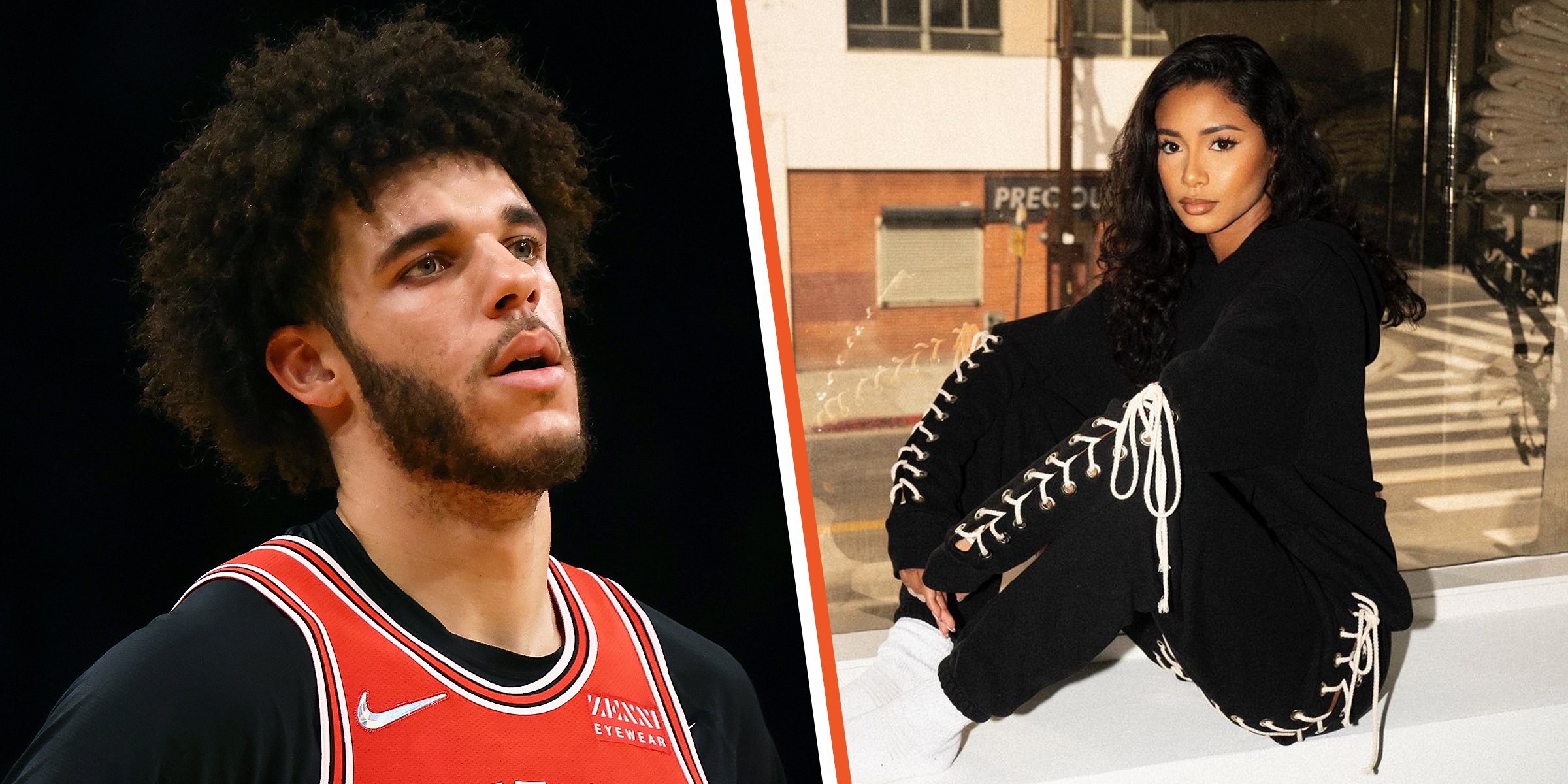

Who is Lonzo Ball’s girlfriend, Ally Rossel?

Lonzo Ball's Girlfriend Inspires Him after Drama with the Mother of His

Ally Rossel : tightdresses