BlackRock's Strategic Lithium Bet: Powering The Future

The global energy landscape is undergoing a monumental shift, driven by an urgent need for sustainable solutions. At the forefront of this transformation, investment giants are strategically positioning themselves to capitalize on the burgeoning demand for critical minerals. In a significant move that underscores this trend, BlackRock, the world's largest money manager, has made headlines with its pivotal involvement in the lithium sector, notably through a strategic agreement that effectively sees BlackRock signs lithium contract, signaling a robust commitment to the future of electric vehicles and renewable energy storage. This development is not merely a transactional event; it represents a calculated expansion into the very bedrock of the green economy, solidifying BlackRock's role as a key enabler of the global energy transition.

This deep dive will explore the multifaceted layers of BlackRock's strategic foray into lithium, from its overarching investment philosophy and recent acquisitions to the specific details of its agreement with Tearlach Resources. We will unpack the significance of this move within the broader context of the energy transition, examining the potential impacts on the market, the regulatory landscape, and what it means for investors looking to understand the future of critical mineral supply chains. Understanding BlackRock's actions in this space provides invaluable insight into the direction of global capital flows and the industries poised for significant growth in the coming decades.

Table of Contents

- The Dawn of a New Era: BlackRock's Strategic Lithium Foray

- Understanding BlackRock: A Global Investment Behemoth

- The Lithium Imperative: Why BlackRock is Investing Heavily

- Decoding the Tearlach Option Agreement: A Deep Dive

- Navigating the Complexities: Regulatory Approvals and Market Dynamics

- Investment Implications and Future Outlook

- Risk Factors and Considerations

- Conclusion: Paving the Way for a Sustainable Future

The Dawn of a New Era: BlackRock's Strategic Lithium Foray

The global race for critical minerals, particularly lithium, is intensifying as nations and industries pivot towards electrification. Lithium, often dubbed "white gold," is indispensable for electric vehicle (EV) batteries, grid-scale energy storage, and a myriad of portable electronic devices. Its demand is projected to skyrocket in the coming years, creating both immense opportunities and significant supply chain challenges. Against this backdrop, the news that BlackRock signs lithium contract is not just a headline; it's a strategic declaration from one of the world's most influential financial institutions, signaling a deep conviction in the future of the lithium market and the broader energy transition.

This strategic move by BlackRock is multifaceted, encompassing direct investments, significant acquisitions, and the development of specialized investment products. It reflects a comprehensive approach to capturing value across the entire lithium ecosystem, from mining and processing to battery manufacturing and end-use applications. For investors and industry observers, BlackRock's actions serve as a powerful indicator of where significant capital is flowing and where future growth is anticipated. This section will lay the groundwork for understanding the broader implications of BlackRock's engagement in the lithium space, setting the stage for a detailed examination of its specific initiatives and partnerships.

Understanding BlackRock: A Global Investment Behemoth

To fully appreciate the significance of BlackRock's moves in the lithium sector, it is essential to first understand the scale and influence of the firm itself. Founded in 1988, initially as an enterprise risk management and fixed income institutional asset manager, BlackRock has grown into an American multinational investment company that stands as the nation's largest asset manager. Managing trillions of dollars for investors, BlackRock is a premier provider of investment management, risk management, and technology platforms. As a fiduciary to investors, it helps grow their money through investments in stocks, bonds, and other assets. BlackRock owns a few companies, such as investment management and technology platforms, and learning about what BlackRock owns and how it makes money can help investors understand its market power.

BlackRock's sheer size and reach mean that its strategic decisions send ripples across global markets. The firm is not just an allocator of capital; it is a shaper of market trends, with a profound impact on corporate governance, sustainability initiatives, and sector-specific growth. Its commitment to the energy transition, articulated by its CEO Larry Fink, is a cornerstone of its long-term strategy, making its direct investments in critical minerals like lithium a natural extension of its stated objectives. Find the latest BlackRock, Inc. (BLK) stock quote, history, news, and other vital information to help you with your stock trading and investing.

BlackRock's Core Business and Influence

BlackRock's core business revolves around managing a vast array of investment products for institutional and individual clients worldwide. This includes mutual funds, exchange-traded funds (ETFs), and various private and alternative investment vehicles. Its iShares brand, a leading provider of ETFs, offers investors exposure to diverse asset classes and market segments, including emerging themes like the energy transition. BlackRock's influence extends beyond mere asset management; its proprietary Aladdin platform provides risk analytics and portfolio management tools used by a significant portion of the financial industry, further solidifying its systemic importance.

The firm is also aiming to double its market cap to $280 billion and targeting $400 billion of cumulative fundraising in private markets by 2030, as stated in an investor presentation. This ambitious growth strategy underscores its proactive stance in identifying and investing in future-growth sectors, with sustainable infrastructure and critical minerals playing a central role.

The GIP Acquisition: A Catalyst for Infrastructure and Energy Transition

A pivotal development preceding BlackRock's direct lithium ventures was its acquisition of Global Infrastructure Partners (GIP). BlackRock's plan to buy private equity firm Global Infrastructure Partners is a $12.5 billion bet by the world’s largest money manager on growing demand for new energy. The nation’s largest asset manager acquired Global Infrastructure Partners on Friday in a deal valued around $12.5 billion, which includes $3 billion in cash and 12 million shares. The Federal Energy Regulatory Commission on Friday approved BlackRock's $12.5 billion deal for Global Infrastructure Partners. This strategic acquisition significantly bolsters BlackRock's capabilities in infrastructure investment, a critical component of the energy transition. The combined infrastructure platform will be instrumental in deploying capital into projects vital for a sustainable future, including renewable energy generation, transmission, and the infrastructure necessary for EV charging and battery manufacturing.

The GIP acquisition positions BlackRock to capitalize on the increasing global demand for new energy infrastructure. It provides the firm with deep expertise and a robust pipeline of projects in areas directly related to the energy transition, from renewable power generation to critical mineral supply chains. This synergy makes BlackRock's subsequent moves in the lithium space a logical and powerful extension of its enhanced infrastructure capabilities.

The Lithium Imperative: Why BlackRock is Investing Heavily

The global economy is undergoing a profound transformation driven by the imperative to decarbonize and transition to cleaner energy sources. At the heart of this transition lies lithium, a light metal with unparalleled properties for energy storage. The demand for lithium has surged dramatically in recent years, propelled primarily by the rapid expansion of the electric vehicle market and the growing need for grid-scale battery storage solutions to integrate intermittent renewable energy sources like solar and wind. This escalating demand creates a compelling investment thesis for firms like BlackRock, which are strategically positioning themselves to capture the immense value generated by this fundamental shift.

BlackRock's heavy investment in lithium is a direct response to this market reality. The firm recognizes that securing access to critical mineral supplies is not just an investment opportunity but a strategic necessity for the global economy's transition away from fossil fuels. By engaging directly in lithium projects and offering specialized investment products, BlackRock is not only seeking financial returns but also aiming to facilitate the very infrastructure required for a sustainable future.

Global Demand and the Energy Transition

The trajectory of global lithium demand is steep and unwavering. Projections indicate a multi-fold increase in consumption over the next decade, driven by ambitious EV production targets from major automakers and national commitments to reduce carbon emissions. This surge is creating a supply deficit, leading to higher prices and a scramble for new, reliable sources of lithium. BlackRock's investment strategy reflects a deep understanding of these market dynamics. They are betting on the long-term, structural growth of the lithium market, recognizing that the energy transition is not a fleeting trend but a fundamental reordering of global energy systems.

Moreover, the geopolitical implications of lithium supply chains are becoming increasingly apparent. Nations are seeking to secure domestic or friendly sources of critical minerals to reduce reliance on potentially unstable or concentrated supply regions. BlackRock, as a global asset manager, is uniquely positioned to navigate these complexities, investing in projects that can contribute to a diversified and resilient global supply.

The Role of ETFs: BlackRock's Approach to Lithium Exposure

Beyond direct investments, BlackRock has also expanded its offerings to allow a broader range of investors to gain exposure to the lithium market. BlackRock looks to capitalize off this trend with a new exchange-traded fund. The financial behemoth has filed a prospectus with the U.S. Securities and Exchange Commission for such a fund. BlackRock iShares has launched a new ETF building on its efforts to tap energy transition opportunities. The iShares Lithium & Battery Producers (LITM) Fund will invest in companies with high exposure to the lithium industry, including miners, refiners, and battery manufacturers. BlackRock has expanded its transition metal offering with a lithium and battery producers ETF, according to ETF Stream, launching the iShares Lithium & Battery Producers UCITS ETF.

The iShares Lithium Miners and Producers ETF (the “Fund”) seeks to track the investment results of an index composed of U.S. and non-U.S. equities of companies that are primarily engaged in the exploration, mining, and production of lithium. These ETFs provide accessible and diversified exposure to the lithium value chain, allowing individual and institutional investors to participate in the growth of this critical sector without the complexities of direct project investment. This approach aligns with BlackRock's broader strategy of democratizing access to investment opportunities while simultaneously channeling capital into key areas of the energy transition.

Decoding the Tearlach Option Agreement: A Deep Dive

The most direct manifestation of BlackRock's commitment to lithium supply is its strategic partnership with Tearlach Resources. BlackRock and Tearlach are parties to an option agreement dated January 10, 2023 (the “Option Agreement”), wherein, among other things, BlackRock has granted Tearlach an option to acquire, in two stages, up to a 70% interest in certain lithium mineral claims. This agreement is a crucial component of BlackRock's strategy to secure future lithium supply, demonstrating a direct involvement in the upstream segment of the value chain. It’s a clear instance where BlackRock signs lithium contract to secure a tangible stake in the future of critical mineral production.

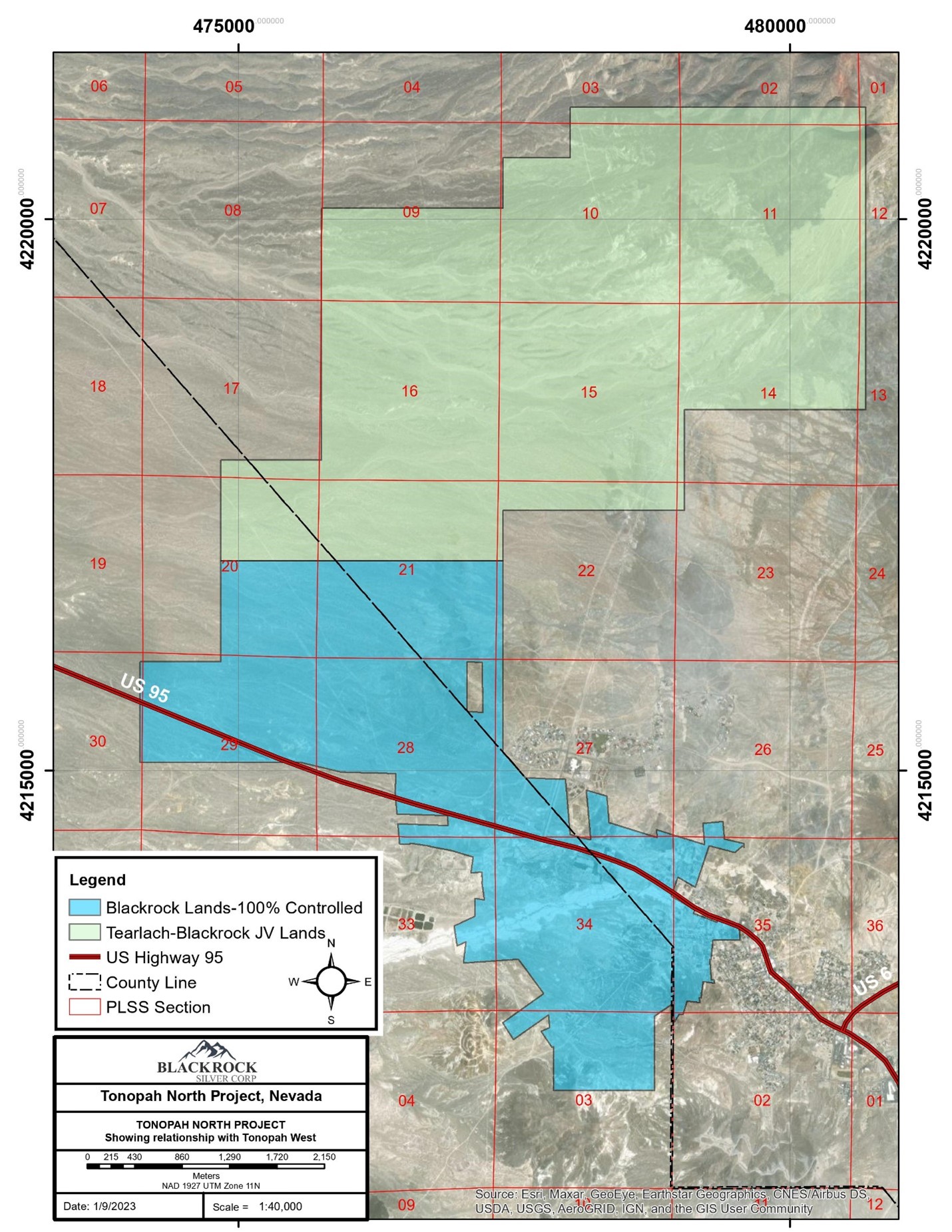

The structure of the option agreement is noteworthy. It grants Tearlach the right, but not the obligation, to acquire a significant stake in the lithium claims, providing flexibility while ensuring BlackRock retains an interest. Subject to the terms of the Option Agreement, BlackRock retains and reserves the rights to explore for, develop, and mine all minerals (including gold and silver) other than lithium. This clause highlights BlackRock's diversified mineral interests while clearly delineating the focus of the Tearlach partnership on lithium specifically. Tearlach has an impressive team with recognized expertise specifically relating to lithium claystone deposits and has proposed an aggressive exploration plan that will see up to US$15,000,000 spent as the project is advanced. This commitment of capital and expertise from Tearlach is vital for the successful development of the project, demonstrating a shared vision for unlocking the lithium potential.

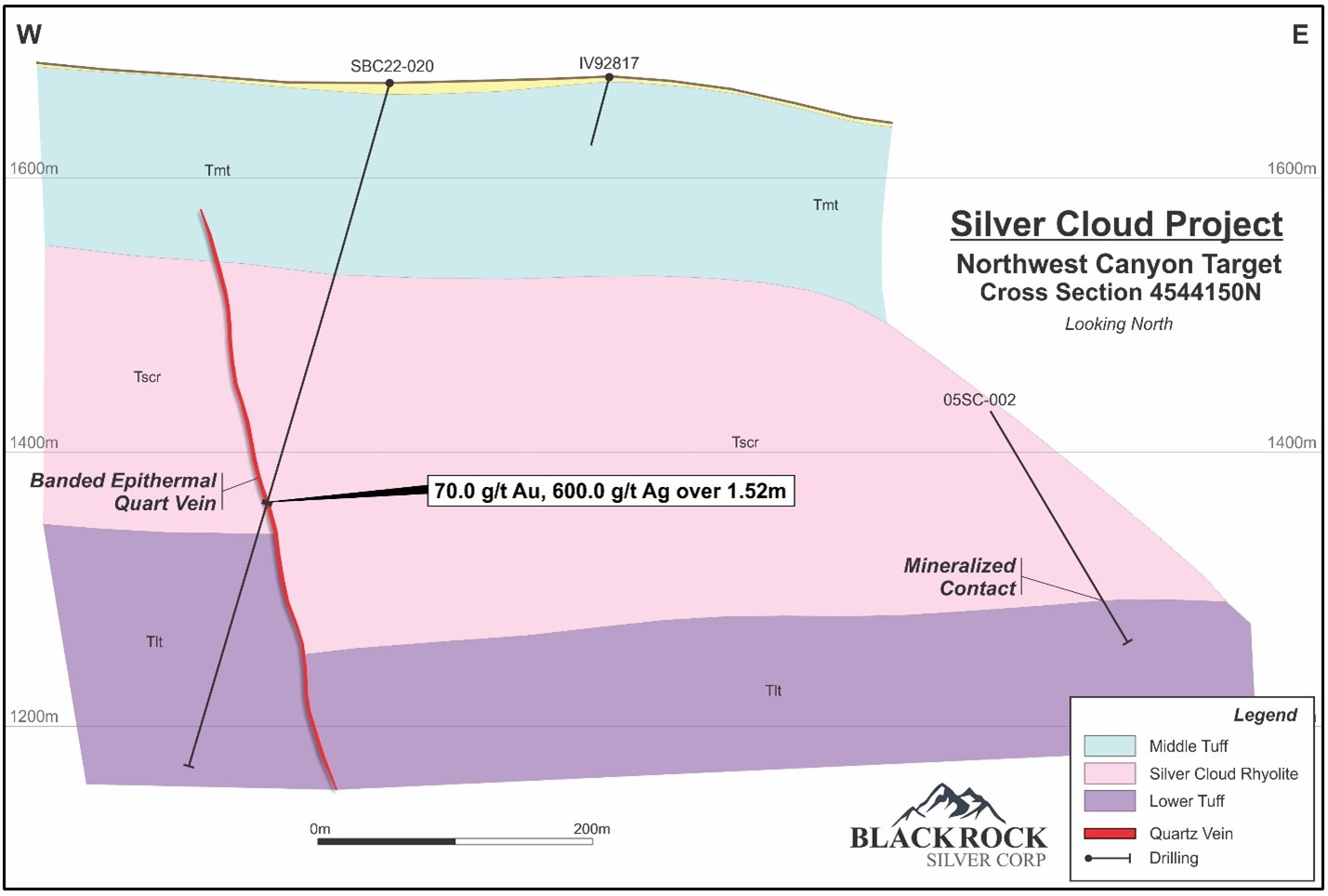

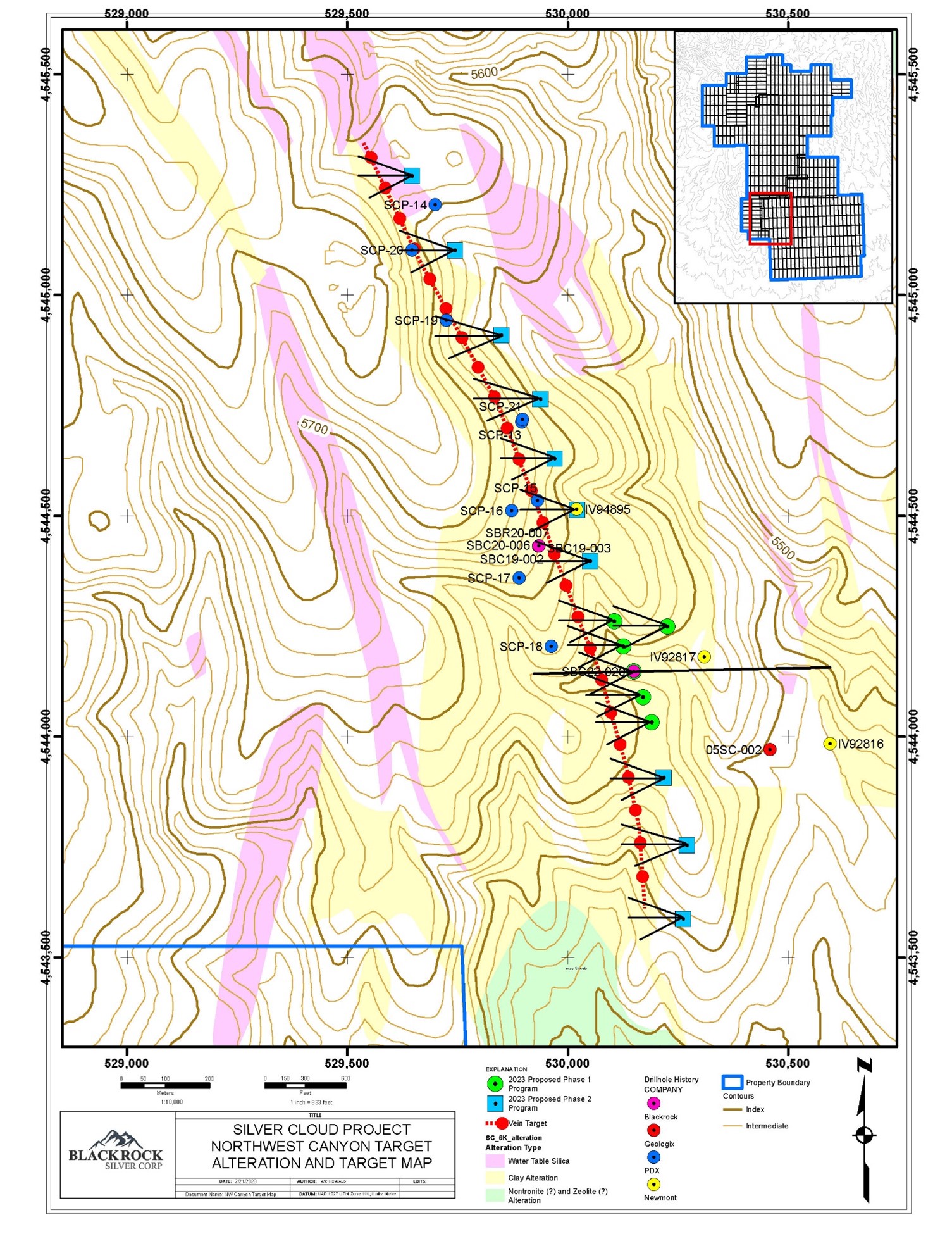

The Tonopah North Project: A Key Asset

Central to the Tearlach option agreement is the Tonopah North Project. These results show the Tonopah North Project has significant lithium potential over a considerable area. A broad lithium zone has been intersected in all drillholes across the Tonopah. With grades up to 1,217 ppm lithium encountered, and thick zones of mineralization up to 56.4 meters starting near surface, initial results compare quite favorably to other well-known lithium deposits globally. The high grades and near-surface mineralization are particularly attractive, as they can significantly reduce mining costs and accelerate project development. This project's promising geological characteristics make it a valuable asset in BlackRock's broader lithium strategy, offering a potential long-term source of the critical mineral.

Furthermore, the BlackRock South Lithium Brine Project is located 72 miles north of the Tesla Gigafactory, 93 miles southwest of Thacker Pass, and 215 miles northwest of the United States’ only producing lithium mine. This strategic geographical proximity to key demand centers and existing infrastructure in Nevada, a burgeoning hub for battery manufacturing and EV production, further enhances the project's appeal and logistical viability. The location minimizes transportation costs and strengthens the domestic supply chain for lithium in the United States, aligning with national strategic interests in critical mineral independence.

Navigating the Complexities: Regulatory Approvals and Market Dynamics

Operating in the critical minerals sector, especially when it involves significant government contracts or large-scale acquisitions, inherently involves navigating a complex web of regulatory approvals and market dynamics. The approval by the Federal Energy Regulatory Commission for BlackRock's $12.5 billion deal for Global Infrastructure Partners highlights the necessary governmental oversight for such substantial transactions, particularly those impacting energy infrastructure. While the provided data mentions "A huge public spat on Thursday saw threats fly over government contracts," this general statement indicates the often contentious and politically charged environment surrounding large-scale infrastructure and resource deals. Such disputes underscore the importance of robust legal frameworks and transparent processes in securing and executing these agreements.

The approval process for mining projects, especially those involving new mineral discoveries like lithium, can be lengthy and fraught with environmental and social considerations. BlackRock's involvement, therefore, signifies not just financial backing but also a commitment to navigating these complexities. Their reputation as a preeminent asset management firm and a premier provider of investment management suggests a capacity for due diligence and adherence to regulatory standards, which are crucial for the successful development of any large-scale mining operation. The market dynamics for lithium are also highly volatile, influenced by global supply-demand imbalances, technological advancements in battery chemistry, and geopolitical tensions. BlackRock's strategic investments are a bet on the long-term stability and growth of this market, requiring a deep understanding of these fluctuating factors.

Investment Implications and Future Outlook

The strategic moves by BlackRock, particularly as BlackRock signs lithium contract and expands its infrastructure portfolio, carry significant implications for investors across various sectors. For those interested in the energy transition, BlackRock's actions validate the long-term investment thesis for critical minerals like lithium. Their direct involvement in projects and the launch of specialized ETFs provide avenues for both direct and indirect exposure to this growth story. Investors can gain insights into the firm's outlook by examining its public filings, such as the prospectus filed with the U.S. Securities and Exchange Commission for its new ETFs, which outline the investment objectives and risks associated with these funds.

The future outlook for lithium remains robust, driven by an accelerating global shift towards electric vehicles and renewable energy storage. BlackRock's proactive stance suggests a belief that the supply side of the equation will struggle to keep pace with demand, leading to sustained high prices and significant returns for well-positioned assets. Furthermore, BlackRock's broader goal of doubling its market cap to $280 billion and targeting $400 billion of cumulative fundraising in private markets by 2030 indicates a strategic focus on long-term, high-growth sectors, with energy transition opportunities being a key pillar. This sustained investment by a firm of BlackRock's stature is likely to attract further capital into the lithium sector, fostering innovation and accelerating the development of new projects and technologies.

Risk Factors and Considerations

While the opportunities in the lithium market are substantial, investors must also be aware of the inherent risks. The mining industry, by its nature, is subject to various operational, environmental, and regulatory challenges. Geopolitical risks, supply chain disruptions, and commodity price volatility can all impact project economics and investor returns. The potential for public spats over government contracts, as mentioned in the provided data, highlights the political sensitivities that can arise in resource development.

For lithium specifically, technological advancements in battery chemistry could potentially reduce reliance on certain types of lithium, although widespread adoption of alternative chemistries is still years away. Environmental concerns related to lithium extraction, particularly for brine projects, can lead to permitting delays and increased operational costs. Furthermore, the aggressive exploration plans proposed by companies like Tearlach, while promising, also carry inherent geological risks; not all exploration efforts result in commercially viable deposits. Investors considering exposure to the lithium sector, whether through direct investments or ETFs like BlackRock's iShares Lithium & Battery Producers (LITM) Fund, should conduct thorough due diligence and understand that these investments are subject to market fluctuations and specific industry risks. BlackRock, as a fiduciary, aims to manage these risks for its clients, but the underlying assets remain exposed to the inherent uncertainties of the mining and energy transition sectors.

Conclusion: Paving the Way for a Sustainable Future

BlackRock's strategic engagement in the lithium sector marks a significant milestone in the global energy transition. By acquiring Global Infrastructure Partners, launching specialized ETFs, and directly engaging in critical mineral projects where BlackRock signs lithium contract with partners like Tearlach Resources for the promising Tonopah North Project, the firm is not merely investing; it is actively shaping the future of sustainable energy. This comprehensive approach underscores BlackRock's conviction in the long-term growth of the lithium market, driven by the insatiable demand for electric vehicles and renewable energy storage solutions.

As the world accelerates its pivot towards a decarbonized economy, access to critical minerals like lithium will remain paramount. BlackRock's actions provide a clear signal to the market about where significant capital and strategic focus are being directed. For investors, this offers both opportunities and a call for careful consideration of the evolving landscape. We encourage readers to delve deeper into the specifics of BlackRock's investment strategies and the dynamics of the lithium market. Share your thoughts in the comments below, or explore other articles on our site to learn more about the companies and trends driving the global energy transition.

BLACKROCK SILVER RECEIVES PERMIT AND SIGNS DRILL CONTRACT TO OFF SET

BLACKROCK SILVER RECEIVES PERMIT AND SIGNS DRILL CONTRACT TO OFF SET

BLACKROCK SILVER ENTERS INTO OPTION AGREEMENT WITH TEARLACH RESOURCES