Safeguarding Your Finances: How To Instantly Block Your GTBank ATM Card

Table of Contents

- Why Blocking Your GTBank ATM Card is Crucial

- Understanding the Urgency: How Fast Does GTBank Respond?

- Official Channels: Multiple Ways to Block Your GTBank ATM Card

- Method 1: Blocking Your GTBank ATM Card via USSD Code

- Method 2: Blocking Your GTBank ATM Card Through SMS

- Method 3: Blocking Your GTBank ATM Card via GTConnect (Customer Care)

- Method 4: Blocking Your GTBank ATM Card Using the GTBank Mobile App/Web

- What Happens After Blocking Your GTBank ATM Card? (Next Steps)

- Important Considerations: Card vs. Account Blocking

- Beyond GTBank: General Advice for Blocking Major ATM Cards in Nigeria

Why Blocking Your GTBank ATM Card is Crucial

The primary reason to know how to block your GTBank ATM card is for your financial safety. Debit cards are unfortunately prime targets for scammers and fraudsters who are constantly looking for ways to swindle individuals out of their money. A compromised card can lead to devastating financial losses if not addressed immediately. Understanding the scenarios where blocking becomes necessary is the first step in safeguarding your funds.Stolen or Lost Card: The Immediate Threat

This is perhaps the most common and urgent scenario. If your ATM debit card is stolen or missing, every second counts. An unblocked card in the wrong hands can be used to withdraw cash, make online purchases, or even drain your account entirely. The moment you realize your card is gone, your immediate priority should be to block it. This action automatically renders the card useless, preventing any further unauthorized transactions. The card will be rejected if it is inserted into any automated teller machine or used for online payments.Suspicious Activity: A Proactive Measure

Even if your physical card is still with you, you might notice suspicious activities on your account statement – transactions you don't recognize, or unusual login attempts. These are clear red flags that your card details might have been compromised, perhaps through a phishing scam, a data breach, or even a sophisticated card skimmer. In such cases, being proactive and blocking your GTBank ATM card can prevent further fraudulent activities and secure your account while you investigate the issue with the bank. It's always better to be safe than sorry when it comes to your money.Understanding the Urgency: How Fast Does GTBank Respond?

When it comes to a stolen or missing ATM card, time is of the essence. GTBank understands this urgency. According to their protocols, GTBank aims to block a stolen ATM card immediately once you report it. Ideally, you should contact their customer service or use one of their instant blocking methods as soon as you discover the card is compromised. The goal is to ensure that no transactions can occur from the moment of your report. While the bank strives for immediate action, the speed of blocking ultimately depends on how quickly you initiate the process through one of their official channels. This highlights the importance of knowing these methods by heart, as relying on someone else to do it for you might introduce delays.Official Channels: Multiple Ways to Block Your GTBank ATM Card

GTBank, recognizing the diverse needs and situations of its customers, provides multiple ways to block your GTBank ATM card. This multi-channel approach ensures that no matter where you are or what resources you have access to, you can take immediate action. There are four primary methods available to you:- Dialling a USSD code

- Sending an SMS

- Calling the GTConnect (customer care) service

- Logging into your mobile app or web platform

Method 1: Blocking Your GTBank ATM Card via USSD Code

The USSD (Unstructured Supplementary Service Data) method is arguably one of the fastest and most convenient ways to block your GTBank ATM card, especially if you don't have internet access or prefer not to use your mobile app. It's a simple, code-based system that works on any mobile phone, regardless of whether it's a smartphone or a feature phone, as long as it has network connectivity. GTBank offers a specific USSD code to immediately block your account or card.Step-by-Step Guide: USSD Code *737*51*10#

This is the most direct and widely recommended USSD code for blocking your GTBank ATM card.- **Dial the Code:** Simply dial `*737*51*10#` on your mobile device. It's crucial that you use the phone number registered with your GTBank account for this to work.

- **Enter Account Number:** Follow the prompts that appear on your screen. You will typically be asked to enter your 10-digit GTBank account number.

- **Confirm Request:** Review the details presented to you and confirm your request to block the card.

- **Input USSD PIN:** Finally, you will be prompted to input your USSD (737) PIN to authenticate the request. This PIN acts as your security measure, ensuring that only you can initiate such a critical action.

Alternative USSD Code: *737*51*74#

There's another USSD code that can be used for similar purposes, often cited for disabling your GTBank ATM card.- **Dial the Code:** Dial `*737*51*74#` from any phone number.

- **Supply Registered Phone Number:** You will then need to supply the phone number you used to register the account. This is a key difference from the first USSD method, making it useful if you're using a different phone.

- **Input USSD (737) PIN:** Just like the previous method, you will need to input your USSD (737) PIN to confirm the action.

Method 2: Blocking Your GTBank ATM Card Through SMS

For those who prefer text-based communication or might be in a situation where making a call or using an app is difficult, blocking your GTBank ATM card via SMS is a convenient alternative. This method leverages the secure connection between your registered mobile number and the bank's system. To block your GTB ATM card through SMS, you need to send a specific message format to a designated number:- **Compose the SMS:** Open your messaging application and create a new message.

- **Message Format:** Type `HOTLIST NUBAN` (replace NUBAN with your account number).

- **Replace NUBAN:** It's critical to replace "NUBAN" with the 10 digits of your account number that is linked to the card you wish to block. For example, if your account number is 0123456789, your message would be `HOTLIST 0123456789`.

- **Send to:** Send this SMS to `08076665555` from your mobile number that is registered with GTBank.

Method 3: Blocking Your GTBank ATM Card via GTConnect (Customer Care)

Sometimes, you might prefer to speak directly with a bank representative, especially if you have additional questions or concerns beyond just blocking the card. Calling the GTConnect service, GTBank's customer care, allows you to do just that. This method provides human assistance and can be reassuring in stressful situations. To block your GTBank ATM card through the customer care number:- **Dial a GTBank Customer Care Number:** You can dial any of the following numbers:

- `+234 700 4826 66328`

- `+234 802 900 2900`

- `+234 803 900 3900`

- `+234 805 900 5900`

- `+234 807 666 5555`

- `+234 816 0000 200`

- `+234 816 0000 300`

- **Follow Prompts/Speak to Agent:** Once connected, follow the automated prompts to reach a customer service representative.

- **Provide Details:** Be prepared to provide your account details, card number (if you remember it), and answer security questions to verify your identity.

- **Request Card Blocking:** Clearly state that you wish to block your GTBank ATM card due to it being lost, stolen, or compromised.

Method 4: Blocking Your GTBank ATM Card Using the GTBank Mobile App/Web

For tech-savvy individuals who are comfortable with digital banking, blocking your GTBank ATM card through the GTBank mobile app or internet banking platform is an incredibly convenient and self-service option. This method gives you direct control over your card's status from anywhere, as long as you have an internet connection.Navigating the Mobile App/Web Interface

The steps are generally similar for both the mobile app and the internet banking website:- **Log In:** Open your GTBank mobile app or navigate to the GTBank internet banking portal on your web browser and log in using your credentials (User ID and Password).

- **Navigate to Cards Section:** Once logged in, look for a section related to 'Cards' or 'Card Services'. The exact naming might vary slightly between the app and the web platform, but it's usually prominently displayed.

- **Select Your Card:** In the cards section, you will see a list of your linked cards. Select the specific GTBank ATM card you wish to block.

- **Click 'Block Card':** Look for an option like 'Block Card', 'Deactivate Card', or 'Hotlist Card'. Click on it.

- **Select Reason for Blocking:** The system will typically ask you to select a reason for blocking the card (e.g., lost, stolen, suspicious activity). Choose the most appropriate reason from the given options.

- **Confirm:** Review the details and confirm your request. You might need to input your transaction PIN or a one-time password (OTP) sent to your registered mobile number for final authentication.

What Happens After Blocking Your GTBank ATM Card? (Next Steps)

Once you successfully block your GTBank ATM card, the card is automatically rendered useless. It will be rejected if inserted into any automated teller machine, point-of-sale (POS) terminal, or used for online transactions. This immediate deactivation is crucial for preventing financial loss. However, blocking your card is only the first step. You will need to request a new ATM card to continue performing card-based transactions. To do this:- **Visit a GTBank Branch:** After blocking, visit any GTBank branch (or First Bank branch, as mentioned in one of the data points, though this seems to be a general advice for major Nigerian banks, GTBank would be the primary choice for a GTBank card).

- **Request a New ATM Card:** Inform the customer service representative that your previous card was blocked and you need to request a new one.

- **Provide Necessary Information:** You will likely need to provide identification and fill out a form for a new card.

- **Card Issuance:** Depending on the branch and card type, you might receive an instant card, or you may need to wait a few business days for your new card to be processed and issued.

Important Considerations: Card vs. Account Blocking

It's vital to understand the distinction between blocking your GTBank ATM debit card and deactivating your entire GTBank account. While it is possible to deactivate your GTBank account if your ATM debit card is stolen or missing, it is generally better to block only your GTBank ATM debit card and not your entire account. * **Blocking the Card:** This action only affects the physical card itself. Your account remains active, and you can still perform transactions through other channels like internet banking, mobile transfers, or over-the-counter services at the bank. This is usually sufficient to prevent fraud stemming from a compromised card. * **Deactivating the Account:** This is a much more drastic measure that essentially freezes all activity on your account. It can cause significant inconvenience as you won't be able to access your funds or conduct any transactions until the account is reactivated, which can be a more complex process. Unless there's a severe security breach affecting your entire account (not just the card), focusing on blocking the card is the recommended and less disruptive approach.Beyond GTBank: General Advice for Blocking Major ATM Cards in Nigeria

While this article focuses on blocking your GTBank ATM card, the principles and types of methods are often similar across major banks in Nigeria. Whether it's Zenith Bank, Access Bank, UBA, or First Bank, most financial institutions provide USSD codes, SMS services, mobile app functionalities, and customer care lines for card blocking. General advice for any ATM card in Nigeria: * **Know Your Bank's USSD Code:** Familiarize yourself with your bank's specific USSD code for card blocking. This is often the quickest method in an emergency. * **Save Customer Care Numbers:** Keep your bank's customer care numbers saved in your phone. * **Utilize Mobile Apps:** If you use mobile banking, learn how to navigate to the card management section within your app. * **Act Immediately:** The moment you suspect your card is compromised, act immediately. Do not delay. * **Report to Authorities (for stolen cards):** If your card was stolen, consider reporting it to the police after blocking it, especially if other items were also taken. * **Monitor Your Account:** After blocking, diligently monitor your account statements for any lingering suspicious activities. In conclusion, the security of your finances rests heavily on your preparedness. Knowing how to block your GTBank ATM card through various reliable channels – USSD, SMS, customer care, or the mobile app – empowers you to take immediate control in critical situations. By understanding these steps and acting swiftly, you significantly reduce the risk of financial fraud and protect your hard-earned money. Don't wait for an emergency; familiarize yourself with these methods today. We hope this guide has provided you with clear, actionable steps to secure your GTBank ATM card. Have you ever had to block your card? Share your experience or any additional tips in the comments below! Your insights can help others in the community.

How to Block my ATM Card (First Bank, GTB, Access) | Koboline

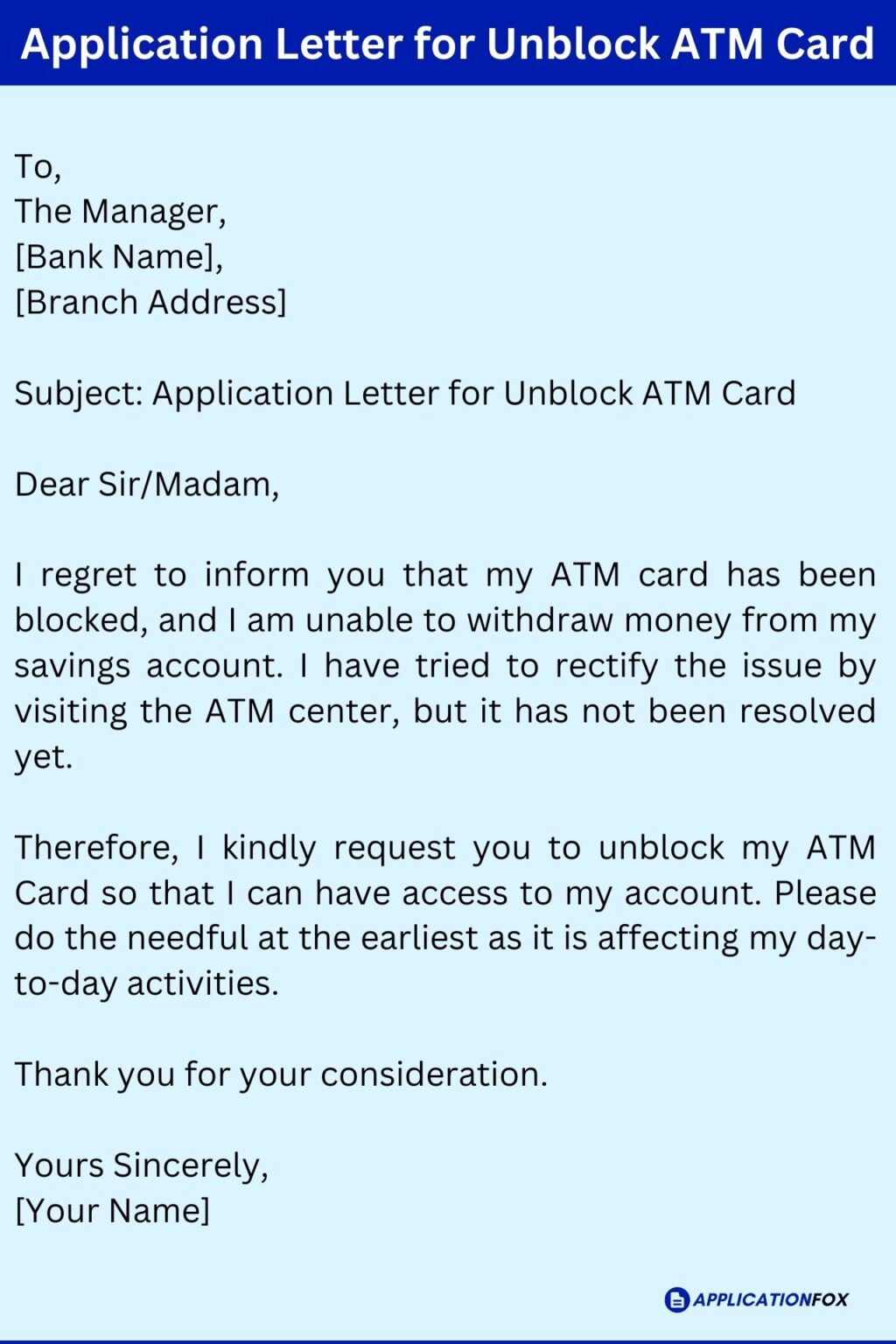

(3+ Samples) Application for Unblock Atm Card

How to Block my ATM Card (First Bank, GTB, Access) | Koboline