Ron Baron: Market Maverick – Unveiling Insights From Baron Capital

In the dynamic world of finance, where fortunes are made and lost with every market swing, certain figures stand out as beacons of insight and experience. While you might have been searching for "Baron Li," the comprehensive data at hand points unequivocally to a different titan of industry: Ron Baron, the visionary founder of Baron Capital. This article delves deep into the mind of Ron Baron, exploring his unique investment philosophy, his candid views on the U.S. economy, and the critical role of trusted financial publications like Barron's in navigating today's complex market landscape.

Understanding the perspectives of seasoned investors like Ron Baron is paramount for anyone seeking to make informed financial decisions. His insights, often shared through platforms like the Economic Club of New York, offer a rare glimpse into the strategies that drive long-term success. Coupled with the robust, real-time analysis provided by Barron's, a cornerstone of financial journalism, investors gain access to the tools and knowledge necessary to comprehend market trends, evaluate investment opportunities, and ultimately, safeguard their financial future in an ever-evolving global economy.

Table of Contents

- Who is Ron Baron? A Glimpse into the Mind of a Market Maverick

- Ron Baron's Investment Philosophy: Building, Not Cutting

- Navigating Economic Headwinds: Ron Baron's Perspective on the U.S. Economy

- Price Targets and Market Outlook: A Look at Baron Capital's Convictions

- Barron's: The Trusted Compass in Financial Markets

- The Synergy of Insight: Ron Baron and Barron's in the Investment Landscape

- Staying Informed: Accessing Premium Financial Insights

- Key Takeaways from Ron Baron's Market Wisdom

Who is Ron Baron? A Glimpse into the Mind of a Market Maverick

Ron Baron is far more than just a name in the financial world; he is a titan of investment, a visionary whose strategies have shaped the portfolios of countless investors for decades. As the founder of Baron Capital, he has cultivated a reputation for identifying growth opportunities and sticking with them through thick and thin. His public appearances, such as his address at the Economic Club of New York, are keenly anticipated events, offering rare insights into his thought process and market outlook. For anyone interested in the nuances of long-term growth investing, understanding Ron Baron's journey and philosophy is essential. He represents a school of thought that prioritizes fundamental analysis and a deep understanding of a company's potential, rather than chasing short-term trends. His firm, Baron Capital, has become synonymous with this patient yet aggressive approach to capital appreciation.Early Life and Entrepreneurial Spirit

While specific details about Ron Baron's early life are often kept private, his career trajectory clearly demonstrates an innate entrepreneurial spirit and a keen eye for business. He began his journey in the investment world at a time when the industry was undergoing significant transformation, laying the groundwork for what would become a highly successful career. This foundational experience allowed him to develop a unique perspective on market dynamics and the intrinsic value of businesses, setting him apart from many of his contemporaries. His early career likely involved rigorous analysis and a commitment to understanding the core drivers of economic growth, skills that would later define his investment firm.Founding Baron Capital: A Vision for Growth

In 1982, Ron Baron established Baron Capital, an investment management firm that would grow to manage billions in assets. The firm was founded on the principle of long-term growth investing, focusing on identifying well-managed, fast-growing companies with significant competitive advantages. Unlike many firms that might chase quarterly earnings, Baron Capital, under Ron Baron's leadership, seeks out businesses that can compound value over many years, often holding positions for a decade or more. This patient approach has allowed the firm to capitalize on the sustained growth of innovative companies, delivering substantial returns to its investors. His vision for Baron Capital was not merely to manage money, but to partner with exceptional businesses and participate in their long-term success.| Personal Data & Biodata: Ron Baron | |

|---|---|

| Full Name | Ronald S. Baron |

| Born | 1943 (Age: 80-81 as of 2024) |

| Nationality | American |

| Alma Mater | Bucknell University (B.A.), George Washington University (J.D.) |

| Occupation | Investor, Fund Manager |

| Known For | Founder and CEO of Baron Capital, Long-term Growth Investing |

| Net Worth (Approx.) | Billions (exact figures fluctuate) |

Ron Baron's Investment Philosophy: Building, Not Cutting

Ron Baron's investment philosophy is deeply rooted in a belief in innovation and growth. He famously stated that a CEO should "resurrect his image as someone who builds things, rather than a person taking a chainsaw to government spending." This statement encapsulates his core belief that true economic progress and investment returns come from creation, expansion, and long-term vision, not merely from cost-cutting or austerity measures. For Ron Baron, this means investing in companies that are actively innovating, expanding their markets, and developing new products or services that genuinely improve lives or solve problems. He looks for businesses with strong management teams, clear growth runways, and the ability to reinvest their earnings back into their operations for future expansion. This approach contrasts sharply with short-term speculative trading, emphasizing instead the compounding power of well-managed, growing enterprises. It's a philosophy that aligns with the idea of investing in the future, fostering economic vitality rather than just managing existing resources.Navigating Economic Headwinds: Ron Baron's Perspective on the U.S. Economy

Ron Baron is known for his candid and often "harsh comments about the U.S." economy, particularly concerning aspects of government spending and policy. While he remains fundamentally optimistic about American innovation and entrepreneurial spirit, he doesn't shy away from pointing out areas where he believes the nation could do better. His critique often stems from his long-term growth perspective; he believes that excessive or misdirected government spending can stifle private sector innovation and create inefficiencies that hinder sustainable economic expansion. He advocates for policies that encourage business growth, technological advancement, and job creation, seeing these as the true engines of prosperity. His insights are not simply complaints but rather a seasoned investor's analysis of the macroeconomic environment and its potential impact on the businesses he invests in. Understanding Ron Baron's views on the broader economic landscape provides crucial context for his investment decisions and his overall market outlook.Price Targets and Market Outlook: A Look at Baron Capital's Convictions

One of the most tangible demonstrations of Ron Baron's conviction in his investments is seen in his firm's price targets. The data reveals a notable instance where "His price target, however, rose to $517 from $427." While the specific company behind this target isn't mentioned in the provided data, this significant increase underscores Baron Capital's deep belief in the long-term potential of certain enterprises. Such upward revisions are not made lightly; they reflect extensive research, a thorough understanding of the company's fundamentals, and confidence in its future growth trajectory. For Ron Baron, price targets are not speculative guesses but rather a reflection of the intrinsic value he perceives in a business over time. This approach contrasts with the often volatile, short-term fluctuations that dominate daily stock market news. It highlights the patient, conviction-driven strategy that has become a hallmark of Ron Baron and his firm. Investors often look to such targets as indicators of where seasoned professionals see value accumulating, providing a different lens through which to view market opportunities.Barron's: The Trusted Compass in Financial Markets

In a world saturated with information, discerning reliable sources is crucial, especially when it comes to financial decisions. This is where Barron's shines as a premier publication. As a Dow Jones product, Barron's provides a comprehensive suite of financial data and analysis that is indispensable for serious investors. From "the latest stock market news, stock price information and stock quote trends inside Barron's market data center" to "real time analysis on investment news and information," Barron's serves as a trusted compass. It offers "a complete Dow Jones Industrial Average overview" and allows users to "view stock market news, stock market data and trading information." The publication covers everything from corporate announcements, like Stellantis naming Antonio Filosa as CEO, to broader economic trends, such as Wall Street's earnings per share expectations. Its commitment to in-depth reporting and expert commentary makes it an authoritative voice in the financial media landscape, providing the context needed to understand complex market movements and the insights of figures like Ron Baron.The Synergy of Insight: Ron Baron and Barron's in the Investment Landscape

The insights of a visionary investor like Ron Baron gain even greater resonance when viewed through the lens of a reputable financial publication like Barron's. While Ron Baron offers a unique, long-term perspective on growth companies and the broader economy, Barron's provides the detailed, up-to-the-minute market data and analytical framework necessary to understand the context of his statements. For instance, when Ron Baron makes "harsh comments about the U.S." or revises a price target, Barron's likely provides the underlying economic data, company reports, and industry analysis that inform such views. The publication's rigorous reporting on antitrust rulings, like the one against Alphabet's Google for violating antitrust law through its dominance of online advertising markets, or detailed earnings reports, such as Wall Street looking for earnings per share of 39 cents, gives investors the granular information they need. This synergy—between the high-level strategic thinking of Ron Baron and the comprehensive, trustworthy data from Barron's—empowers investors to make well-informed decisions, moving beyond mere speculation to data-driven conviction.Staying Informed: Accessing Premium Financial Insights

In the realm of "Your Money or Your Life" (YMYL) topics, such as investments, access to accurate, timely, and expert information is not just beneficial—it's critical. Publications like Barron's understand this imperative, offering premium content through subscription models. The data highlights this, noting that users can "continue reading this article with a Barron’s subscription" and that "your sign in credentials (email address and password) are universal and will be used to provide you with access to the Dow Jones and affiliate products below." This integrated access underscores the value of subscribing to professional financial journalism. It ensures that readers receive not just headlines, but deep dives into market trends, company analyses, and expert opinions from sources that adhere to the highest standards of journalistic integrity and financial reporting. In an age of information overload, paying for quality content from established sources like Barron's becomes an investment in itself, safeguarding against misinformation and providing a competitive edge.The Dow Jones Ecosystem: Beyond Barron's

Barron's is an integral part of the larger Dow Jones ecosystem, which includes other powerhouse financial news entities. This affiliation means that subscribers often gain access to a broader suite of tools and information, ensuring a comprehensive view of the global markets. The universal sign-in credentials mentioned in the data point to this interconnectedness, allowing users to seamlessly navigate between various Dow Jones products. This ecosystem provides a robust foundation for financial literacy and decision-making, offering everything from real-time stock quotes to in-depth investigative reports. For serious investors, this integrated access means having a wealth of verified, expert-driven data at their fingertips, enabling them to react quickly to market changes and conduct thorough due diligence on potential investments.Why Expert Analysis Matters in YMYL Contexts

When dealing with "Your Money or Your Life" topics, the principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) are paramount. This is precisely why sources like Barron's and the insights from figures like Ron Baron are so valuable. They provide information rooted in years of experience, backed by deep expertise, presented by authoritative voices, and delivered with unwavering trustworthiness. In financial markets, where a single piece of misinformation can lead to significant losses, relying on vetted, professional analysis is non-negotiable. Whether it's understanding the implications of a federal judge's ruling on antitrust law, interpreting earnings per share data, or evaluating a CEO's strategic vision, expert analysis helps bridge the gap between raw data and actionable insights, empowering individuals to make sound financial choices that directly impact their well-being.Key Takeaways from Ron Baron's Market Wisdom

Ron Baron's approach to investing offers several enduring lessons for both seasoned and novice investors. Firstly, his emphasis on "building things" rather than "taking a chainsaw" highlights the importance of investing in innovation and long-term growth. This patient, conviction-driven strategy has been a cornerstone of Baron Capital's success. Secondly, his willingness to offer "harsh comments about the U.S." economy demonstrates the critical need for investors to critically assess the broader macroeconomic environment and its potential impacts. Thirdly, the upward revision of his price targets, such as from $427 to $517, underscores the power of deep fundamental research and unwavering belief in a company's intrinsic value. Finally, the consistent reliance on and reference to publications like Barron's reinforces the indispensable role of trustworthy, expert financial journalism in navigating the complexities of the stock market. These elements combined form a powerful framework for anyone seeking to build wealth responsibly and sustainably.Conclusion

In the intricate dance of the global financial markets, understanding the wisdom of experienced investors like Ron Baron, coupled with access to reliable data from authoritative sources like Barron's, is truly invaluable. Ron Baron's long-term growth philosophy, his candid assessments of economic realities, and his firm's conviction in their investments provide a powerful lens through which to view market opportunities. Simultaneously, Barron's stands as a beacon of trustworthiness, offering the real-time analysis, comprehensive data, and expert commentary essential for informed decision-making in the critical YMYL domain of finance. As you continue your journey through the world of investments, remember the synergy between visionary insights and credible information. We encourage you to explore the vast resources available at Barron's market data center, delve deeper into the investment strategies of figures like Ron Baron, and always prioritize expert-backed analysis for your financial well-being. What are your thoughts on Ron Baron's "build things" philosophy? Share your insights in the comments below, and consider subscribing to Barron's for unparalleled access to market intelligence that can truly make a difference in your financial future.

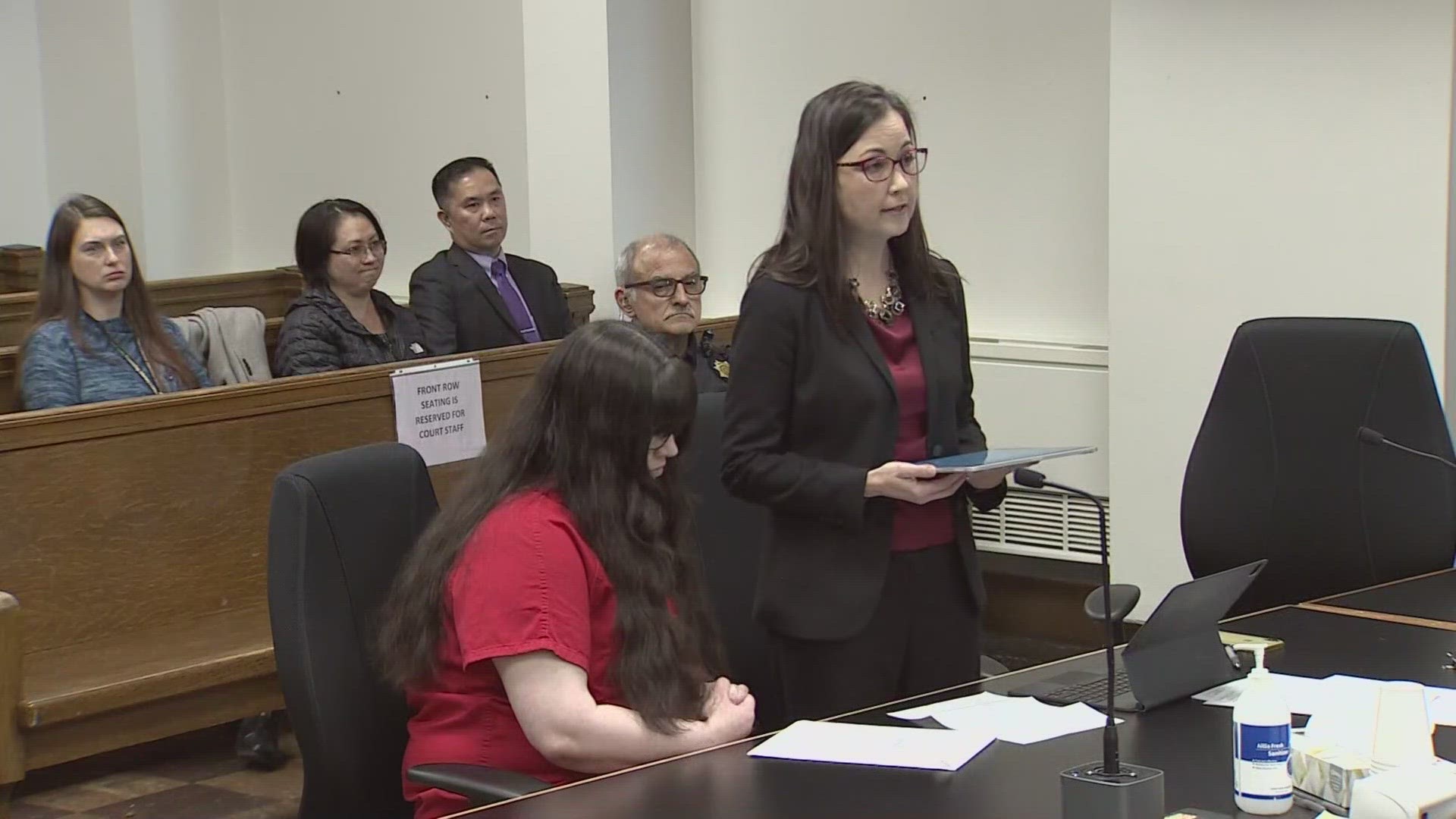

Woman who plead guilty hiring teens to kill ex-husband sentenced

:max_bytes(150000):strip_icc():focal(773x210:775x212)/Baron-Li-120324-tout-02-211f062c156a46bc934fe33fa1d185f6.jpg)

Wash. Dad Spent More Than A Year Recovering From Near-Fatal 2020 Shooting

Where is Baron Li now? Details explored ahead of People Magazine