Palmpay USSD Code: Your Ultimate Guide To Seamless Money Transfers

In an increasingly digital world, the ability to manage your finances on the go is no longer a luxury but a necessity. For millions across Nigeria, mobile payment platforms like Palmpay have become indispensable tools for daily transactions. Whether you're looking to send money to family, pay for goods, or top up your airtime, the convenience of these services is undeniable. However, not everyone has constant access to the internet or a smartphone capable of running sophisticated apps. This is where the power of USSD (Unstructured Supplementary Service Data) codes comes into play, offering a robust and accessible alternative for managing your funds. Specifically, understanding the Palmpay USSD code to transfer money is crucial for anyone seeking to perform transactions swiftly and without an internet connection.

This comprehensive guide will delve deep into the functionalities of Palmpay's USSD services, focusing primarily on how you can leverage these simple codes for money transfers. We'll explore the various codes, their specific uses, and provide step-by-step instructions to ensure your transactions are smooth, secure, and successful. By the end of this article, you'll be equipped with all the knowledge needed to confidently navigate Palmpay's USSD ecosystem, making your financial life significantly easier.

Table of Contents

- Understanding USSD: The Power of Simple Codes

- What is Palmpay? A Gateway to Digital Transactions

- The Core Palmpay USSD Code for All Your Needs

- Mastering Palmpay USSD Code to Transfer Money: A Step-by-Step Guide

- Beyond Transfers: Other Essential Palmpay USSD Services

- Funding Your Palmpay Account via USSD: Specific Bank Examples

- Security and Convenience: Why Palmpay USSD Matters

- Troubleshooting Common Palmpay USSD Issues

Understanding USSD: The Power of Simple Codes

USSD, or Unstructured Supplementary Service Data, is a global system for sending text messages between a mobile phone and an application program in the network. Unlike SMS (Short Message Service), USSD creates a real-time connection during a session, allowing for two-way communication. This makes it ideal for interactive services like mobile banking, balance inquiries, and, most importantly for our discussion, money transfers. The beauty of USSD lies in its simplicity and accessibility. It doesn't require a smartphone, internet connection, or even a data plan. Any basic feature phone can utilize USSD codes, bridging the digital divide and bringing financial services to a broader population, particularly in regions where internet penetration might still be developing.

In Nigeria, USSD has become a cornerstone of the financial technology landscape. It empowers millions to perform various banking and payment operations directly from their mobile phones, irrespective of their device's sophistication or network connectivity. This technology is particularly vital in rural areas or during times of network instability, ensuring that financial transactions remain possible. The ubiquity of mobile phones in Nigeria means that USSD offers an unparalleled reach, making it a critical component of financial inclusion efforts. It's a testament to how simple, yet powerful, technology can transform everyday life, enabling quick and secure access to funds and services.

What is Palmpay? A Gateway to Digital Transactions

Palmpay is a rapidly growing mobile payment service that has carved out a significant niche in the Nigerian fintech market. Launched with the vision of making financial services more accessible and convenient, Palmpay allows its users to perform a wide array of transactions directly from their mobile devices. Beyond just sending and receiving money, the platform facilitates the purchase of airtime and data, payment of utility bills, and various other essential financial operations. It acts as a digital wallet, providing a secure and efficient way to manage funds without the need for traditional banking infrastructure for every transaction.

The platform's user-friendly mobile application is a major draw, offering a seamless experience for smartphone users. However, recognizing the diverse technological landscape, Palmpay has also heavily invested in its USSD capabilities. This dual approach ensures that whether you're tech-savvy with the latest smartphone or prefer the simplicity of a feature phone, you can still access Palmpay's robust services. The emphasis on providing a comprehensive suite of services, from simple transfers to loan applications, underscores Palmpay's commitment to being a holistic financial partner for its users, making daily financial management both simple and secure.

The Core Palmpay USSD Code for All Your Needs

When it comes to interacting with your Palmpay account via USSD, there are a couple of key codes you'll encounter, each serving slightly different purposes. The primary and most versatile Palmpay USSD code is *861#. This code acts as a central gateway to a wide range of services offered by Palmpay, all accessible without an internet connection. By dialing *861#, users can initiate money transfers, purchase airtime, buy data bundles, check their account balance, and even pay bills. It's designed to be the go-to code for managing your Palmpay account directly from your phone's dialer, offering a comprehensive menu of options once dialed.

However, the provided data also highlights *652# as a significant Palmpay USSD code, specifically mentioning its use for transfers and loans. While *861# serves as the broader access code, *652# appears to be a direct shortcut for initiating money transfers and accessing loan options, simplifying the process for these common transactions. It's possible that *652# functions as a more direct route for specific high-frequency actions, or it might be an older or alternative code still in use. For the purpose of transferring money, both codes are relevant, but *861# generally provides a more comprehensive menu of Palmpay services, including the option to transfer funds. Users should remember to set up a secure PIN with their Palmpay account to authorize any transactions initiated via USSD, ensuring the security of their funds.

Mastering Palmpay USSD Code to Transfer Money: A Step-by-Step Guide

The core of this guide lies in understanding how to effectively use the Palmpay USSD code to transfer money. This process is designed to be straightforward, ensuring that even those less familiar with mobile banking can complete transactions with ease. Whether you're sending money to another Palmpay user or to a traditional bank account, the steps are intuitive. The key is to have your recipient's details ready and your secure Palmpay PIN memorized. The convenience of not needing an internet connection for these transfers cannot be overstated, making it a reliable option in various scenarios.

Before you begin, ensure your phone number is registered with Palmpay and your account is active. If you haven't already, you'll be prompted to set up a secure PIN during your first USSD interaction. This PIN is vital for authorizing transactions and protecting your funds. Always keep your PIN confidential and never share it with anyone. Now, let's break down the steps for different types of transfers using the Palmpay USSD code.

Transferring to Other Palmpay Users

Sending money to another Palmpay user is incredibly simple and often instant. This is ideal for peer-to-peer payments, splitting bills, or sending money to family members who also use the platform. Here’s how you can do it using the Palmpay USSD code:

- Dial the Palmpay USSD Code: On your mobile phone, dial *652# or *861# and press the call button. The data suggests *652# is a direct route for transfers.

- Select the Transfer Option: A menu will appear on your screen. Look for the option that says "Transfer Money" or "Send Money" and select it by entering the corresponding number.

- Choose Recipient Type: You might be asked if you want to transfer to another Palmpay user or a bank account. Select the option for "Palmpay User" or "Palmpay to Palmpay."

- Enter Recipient's Phone Number: Input the phone number associated with the recipient's Palmpay account. Double-check this number carefully to avoid sending money to the wrong person.

- Enter Amount: Key in the amount of money you wish to transfer.

- Confirm Transaction: Review the details of the transaction (recipient's number, amount). If everything is correct, you will be prompted to enter your secure Palmpay PIN.

- Complete Transfer: Enter your PIN and confirm. You will receive an SMS notification confirming the success of your transaction.

This process is designed for speed and efficiency, ensuring that funds reach the recipient almost immediately, making it a highly convenient option for everyday transactions.

Sending Money to Bank Accounts

While Palmpay-to-Palmpay transfers are common, you might also need to send money from your Palmpay account to a traditional bank account. This is equally feasible via USSD, although the process might involve a few more steps depending on the menu options. Here’s a general guide:

- Dial the Palmpay USSD Code: Start by dialing *861# or *652# on your phone and press the call button. As *861# is the more comprehensive code, it's often a good starting point for various services.

- Navigate to Transfer Option: From the displayed menu, select the option for "Transfer Money" or "Send Money."

- Choose Bank Transfer: When prompted to select the recipient type, choose "To Bank Account" or "Other Banks."

- Select Recipient Bank: A list of banks will typically appear. Select the bank where the recipient's account is held.

- Enter Account Number: Carefully input the recipient's bank account number. Accuracy is paramount here.

- Enter Amount: Specify the amount of money you wish to transfer.

- Confirm Details: The system will usually display the recipient's name (as per their bank account) for verification. Confirm that the name matches your intended recipient.

- Enter Your Palmpay PIN: To authorize the transaction, enter your secure Palmpay PIN.

- Complete Transfer: Confirm the transaction. You will receive a confirmation message, and the funds should reflect in the recipient's bank account shortly, though inter-bank transfers might take a few minutes.

This functionality makes Palmpay's USSD service a powerful tool for bridging the gap between mobile wallets and traditional banking, offering flexibility for all your financial needs.

Beyond Transfers: Other Essential Palmpay USSD Services

While the focus of this article is on the Palmpay USSD code to transfer money, it's important to recognize that Palmpay's USSD capabilities extend far beyond just sending funds. The versatility of these codes makes them invaluable for a variety of daily financial tasks, providing a comprehensive mobile banking experience even without internet access. From managing your account balance to accessing credit, Palmpay's USSD services aim to cover essential user needs. Understanding these additional functionalities can further enhance your experience and reliance on the platform.

The primary code, *861#, serves as a robust gateway to almost all Palmpay services. This means that once you dial this code, you're presented with a menu that allows you to navigate to different sections, including those for airtime, data, bill payments, and more. This integrated approach ensures that users don't need to remember multiple codes for different services, streamlining their interaction with their Palmpay account. Let's explore some of these other crucial services available via Palmpay USSD.

Checking Your Palmpay Balance with USSD

One of the most frequently performed actions in mobile banking is checking your account balance. With Palmpay USSD, this is a quick and effortless process. Knowing your balance helps you manage your spending and ensure you have sufficient funds for upcoming transactions. Here's how to do it:

- Dial the Palmpay USSD Code: Dial *861# or *652# on your mobile phone and press the call button.

- Select Balance Inquiry: From the menu that appears, look for an option like "Check Balance" or "Account Balance." Select the corresponding number.

- Enter PIN (if required): You may be prompted to enter your Palmpay PIN to verify your identity.

- View Balance: Your current Palmpay account balance will be displayed on your screen.

This simple process ensures you're always aware of your financial standing, empowering you to make informed decisions about your spending and transfers.

Accessing Loans and Airtime Purchases

Palmpay also offers the convenience of purchasing airtime and data, as well as applying for loans, all through USSD. This is particularly useful when you're out of data or in urgent need of a small credit facility. The process is integrated into the same USSD menu structure:

- For Airtime and Data Purchase:

- Dial *861#.

- From the menu, select the option for "Airtime" or "Data."

- Follow the prompts to choose your network, enter the amount, and confirm with your PIN.

- For Loan Application:

- Dial *652#. The data specifically mentions this code for loans.

- From the menu, select the "Loan" option.

- Follow the on-screen instructions to check your eligibility, view available loan amounts, and apply. This option simplifies the loan application process, enabling you to access funds swiftly, subject to Palmpay's lending criteria.

These additional services highlight Palmpay's commitment to being a versatile financial tool, catering to a wide range of user needs beyond just the Palmpay USSD code to transfer money.

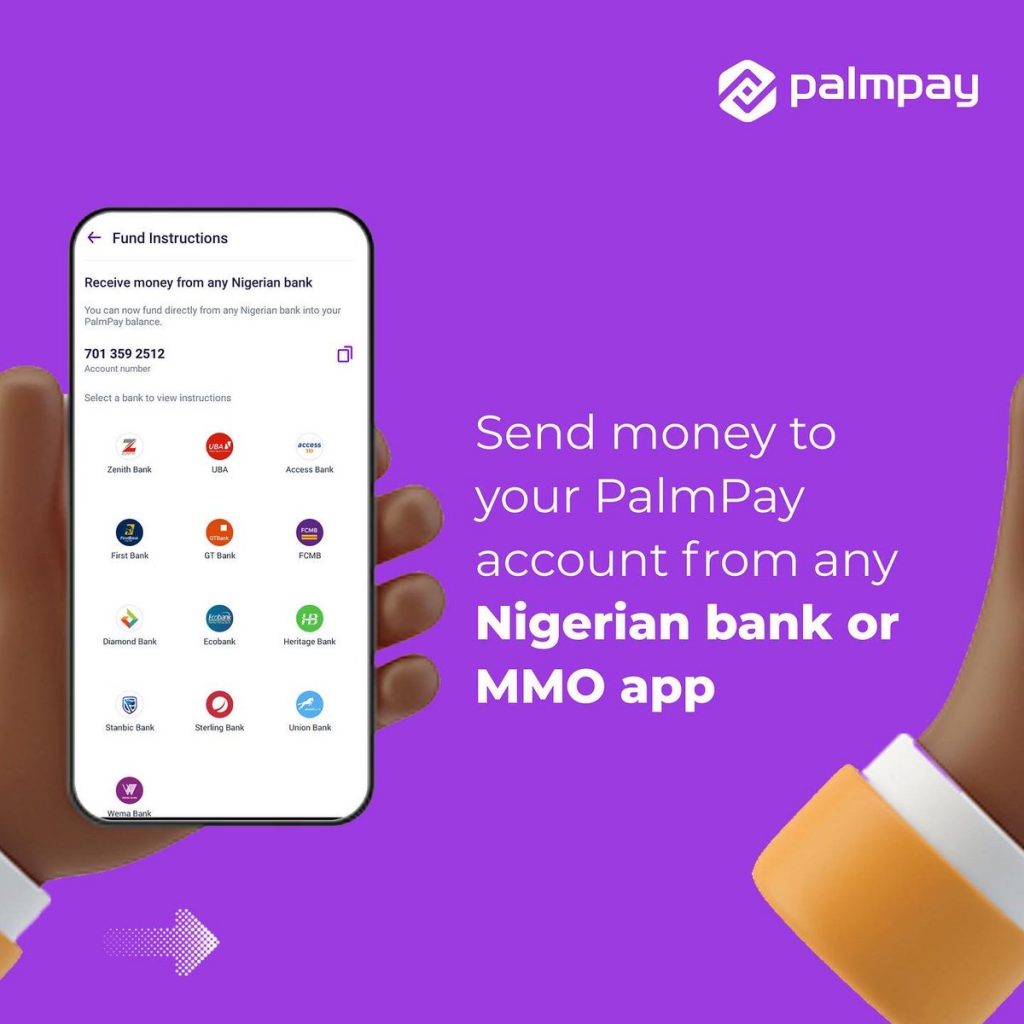

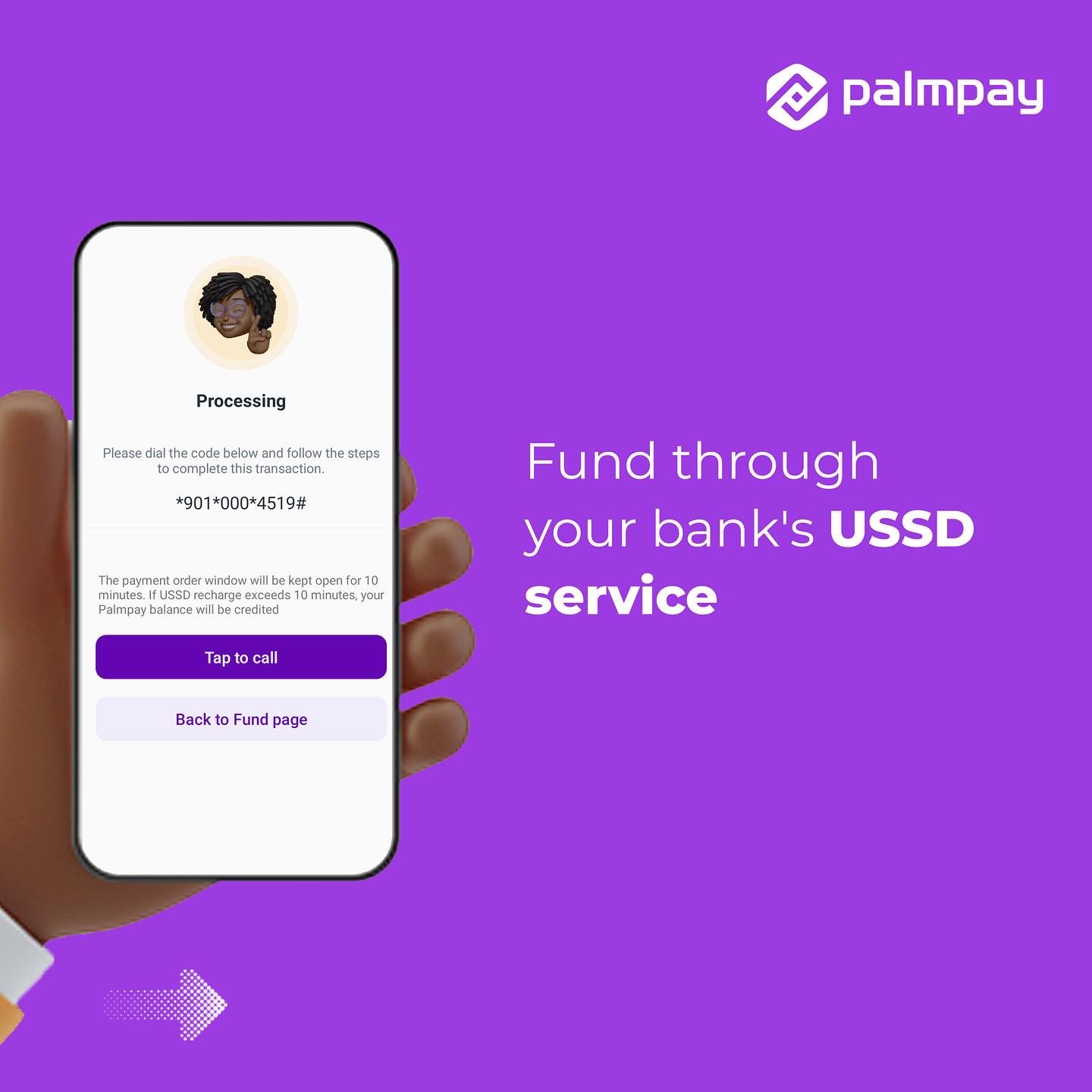

Funding Your Palmpay Account via USSD: Specific Bank Examples

Before you can use the Palmpay USSD code to transfer money or perform any other transaction, you'll need to ensure your Palmpay account is funded. While direct funding via Palmpay's own USSD codes is not typically how you *deposit* money into Palmpay from your bank, you can use your bank's specific USSD codes to push funds to your Palmpay account. This is a common method for users who prefer not to use mobile banking apps or online transfers. The process generally involves using your bank's unique USSD code for transfers and inputting your Palmpay account number as the recipient.

The provided data offers specific examples for funding your Palmpay account from certain banks:

- From Access Bank: To fund your Palmpay account from Access Bank using USSD, you would dial *901*amount*palmpay account number#. For example, if you want to transfer 500 Naira to Palmpay account number 1234567890, you would dial *901*500*1234567890#. This direct method streamlines the process of moving funds from your Access Bank account to your Palmpay wallet.

- From GTBank: For GTBank users, the process involves using GTBank's general USSD banking code. To send money from a GTBank account to Palmpay, you would typically dial *737# on your phone. Once you dial this code, you'll navigate through the menu to select "Transfers," then choose "Other Banks" or "Wallets," and finally input your Palmpay account number and the amount. This integration with major banks' USSD platforms ensures that funding your Palmpay wallet is as convenient as any other bank transfer.

It's important to note that while the Palmpay USSD code for transfer is used for *outbound* transactions from your Palmpay wallet, these bank-specific USSD codes are for *inbound* transactions, allowing you to top up your Palmpay balance directly from your bank account. Always verify the latest USSD codes and procedures with your specific bank, as these can sometimes change.

Security and Convenience: Why Palmpay USSD Matters

In the realm of digital finance, two factors reign supreme: security and convenience. Palmpay's USSD services excel in both, making them a preferred choice for millions of users, especially in a market like Nigeria. The inherent design of USSD technology offers a layer of security that internet-dependent transactions sometimes lack. Since USSD sessions operate over a secure, dedicated channel directly with the mobile network, they are less susceptible to common internet-based threats like phishing or malware attacks that target web browsers or apps. Every transaction initiated via the Palmpay USSD code to transfer money or perform other actions is protected by your unique and confidential Palmpay PIN, which acts as your digital signature.

Beyond security, the convenience factor of Palmpay USSD is unparalleled. The ability to conduct financial transactions without requiring a smartphone or an active internet connection is a game-changer for financial inclusion. This means that users in remote areas with limited internet infrastructure, or those who simply prefer feature phones, can still fully participate in the digital economy. The speed of USSD transactions is another significant advantage; a simple dial and a few menu selections can complete a transfer in seconds. This immediacy is crucial for urgent payments or when time is of the essence. In a dynamic economy like Nigeria, where financial growth is increasingly tied to digital access, USSD services, including the Palmpay USSD code for transfer, play a vital role in ensuring that everyone, regardless of their technological access, can manage their money efficiently and securely. A great credit score is basic for monetary development in Nigeria, particularly in 2025, as it determines your capacity to get to credits, secure way better intrigued rates, and this digital access contributes to that financial empowerment.

Troubleshooting Common Palmpay USSD Issues

While using the Palmpay USSD code for transfer and other services is generally smooth, users might occasionally encounter issues. Understanding common problems and their solutions can save you time and frustration. Most USSD-related issues are minor and can be resolved with simple steps.

- "Connection Problem" or "USSD Code Not Running":

- Network Issues: Ensure you have sufficient network signal. USSD relies on your mobile network.

- SIM Card Issues: Make sure your SIM card is properly inserted and active. Try restarting your phone.

- Temporary Glitch: Sometimes, it's a temporary network or system glitch. Wait a few minutes and try again.

- Incorrect PIN Issues:

- PIN Mismatch: Double-check that you are entering the correct Palmpay PIN. It's easy to make a typo.

- Forgotten PIN: If you've forgotten your PIN, you might need to reset it. This usually involves dialing the main USSD code (*861#) and looking for a "Forgot PIN" or "Reset PIN" option within the menu, or contacting Palmpay customer support.

- Transaction Failure (Funds Not Sent/Received):

- Insufficient Balance: Always check your Palmpay balance before initiating a transfer.

- Incorrect Recipient Details: The most common reason for failed transfers is an incorrect phone number or bank account number. Always verify details before confirming.

- Network Congestion: During peak hours, transactions might take longer or fail due to network congestion. Try again later.

- Daily Limits: Be aware of any daily transaction limits set by Palmpay or your bank.

- Palmpay System Issues: Rarely, Palmpay's system might be experiencing downtime. Check their social media or contact customer support for updates.

- Slow Response Time:

- This can be due to network congestion or high traffic on Palmpay's servers. Patience is key; the transaction will usually go through.

If you've tried these basic troubleshooting steps and the issue persists, the best course of action is to contact Palmpay's customer support. They can provide specific assistance tailored to your account and the problem you're facing. Always be prepared to provide your Palmpay account details and the specifics of the failed transaction.

Conclusion

The Palmpay USSD code for transfer, along with its other versatile USSD functionalities, represents a significant leap forward in making financial services accessible and convenient for everyone in Nigeria. Whether you're sending money to loved ones, paying bills, or simply checking your balance, the ability to perform these actions without an internet connection or a smartphone is invaluable. The codes *861# and *652# serve as powerful tools, empowering users to manage their finances efficiently, securely, and on the go.

Embracing Palmpay's USSD services means embracing a future where financial transactions are no longer limited by technology

Palmpay USSD Code For Transfer, Buy Data and Check Balance (Without

PalmPay Bank USSD Code for Mobile Banking Transactions, Transfer Codes

Palmpay USSD Code To Transfer, Check Balance & For Airtime Purchase