Canoo's Downfall: Unpacking The EV Startup's Delisting & Bankruptcy

The story of Canoo Inc. (GOEV), once a beacon of innovation in the electric vehicle (EV) sector, has reached a somber conclusion, culminating in its delisting from the Nasdaq exchange and a Chapter 7 bankruptcy filing. This dramatic turn of events marks a significant inflection point for a company that began with ambitious promises, capturing the imagination of investors eager to ride the wave of EV disruption. From its initial public offering (IPO) to its final moments, Canoo's journey serves as a stark reminder of the volatile and often unforgiving nature of high-growth, capital-intensive industries like electric vehicle manufacturing.

For many, Canoo's trajectory from a highly anticipated startup to a cautionary tale underscores the immense challenges faced by new entrants in a market dominated by established giants and fierce competition. This article delves into the critical factors that led to Canoo's demise, exploring its financial struggles, regulatory hurdles, and the broader implications for investors and the EV industry at large. Understanding the intricacies of Canoo's collapse offers invaluable lessons on market dynamics, financial prudence, and the inherent risks of speculative investments.

Table of Contents

- The Rise and Fall of an EV Innovator

- Navigating Nasdaq's Strict Waters: The Delisting Threat

- A Bleeding Balance Sheet: Canoo's Financial Woes

- The Stock Market's Harsh Verdict: GOEV's Plummeting Value

- The Inevitable End: Chapter 7 Bankruptcy Filing

- A Glimmer of Hope? The Arrival Acquisition

- Beyond the Financials: Operational Shifts and Industry Warnings

- Lessons from Canoo's Collapse: A Cautionary Tale for Investors

The Rise and Fall of an EV Innovator

Canoo Inc., originally known as Hennessy Capital Acquisition Corp IV, burst onto the scene with a unique vision for electric vehicles. Operating under the industrial classification code 3714, which encompasses automotive parts manufacturing, Canoo aimed to revolutionize the EV landscape with its distinctive "skateboard" platform and modular vehicle designs. These designs promised unprecedented flexibility and efficiency, allowing for a variety of vehicle types to be built on a common chassis, from lifestyle vehicles to commercial delivery vans. At one point, the company even pursued a joint development partnership with Hyundai Motor Group, a testament to the perceived innovation and potential of its technology. This collaboration, though ultimately short-lived, fueled significant excitement and positioned Canoo as a promising contender in the burgeoning EV market.

The initial buzz around Canoo was palpable. Investors, buoyed by the success of Tesla and the overall enthusiasm for sustainable transportation, poured capital into EV startups, hoping to find the "next big thing." Canoo, with its innovative approach and charismatic leadership, seemed to fit the bill perfectly. Its sleek, futuristic prototypes and ambitious production targets painted a picture of a company poised for rapid growth and market disruption. However, the journey from concept to mass production in the automotive industry is fraught with immense capital requirements, complex supply chain challenges, and regulatory hurdles. What seemed like a bright future for Canoo began to dim as the company struggled to transition from prototypes to scalable manufacturing, revealing the profound difficulties inherent in bringing a new automotive company to fruition.

Navigating Nasdaq's Strict Waters: The Delisting Threat

The path to becoming a publicly traded company on a major exchange like Nasdaq comes with stringent requirements, designed to protect investors and ensure market integrity. Canoo, despite its initial listing, soon found itself struggling to meet these continuous listing standards. The company received multiple warnings from Nasdaq regarding its non-compliance, signaling deep-seated issues that went beyond mere operational hiccups. Exchanges like Nasdaq maintain strict criteria related to minimum bid price, market capitalization, and shareholder equity, among others. Failing to adhere to these benchmarks can trigger a delisting process, effectively removing a company's shares from the public trading arena.

The threat of delisting is a severe blow to any company, as it drastically reduces liquidity for shareholders and often leads to a significant loss of investor confidence. For Canoo, the consistent failure to meet Nasdaq's standards was a clear indicator of its deteriorating financial health and operational instability. While some exchanges, like Nasdaq, are perceived as slightly more lenient than others, such as the New York Stock Exchange (NYSE) which is known for its particularly strict delisting rules, the fundamental principle remains: public companies must demonstrate ongoing viability and adherence to market regulations. The looming prospect of Canoo's delisting served as an early warning sign to investors that the company's future on the public market was precarious, long before its ultimate bankruptcy.

A Bleeding Balance Sheet: Canoo's Financial Woes

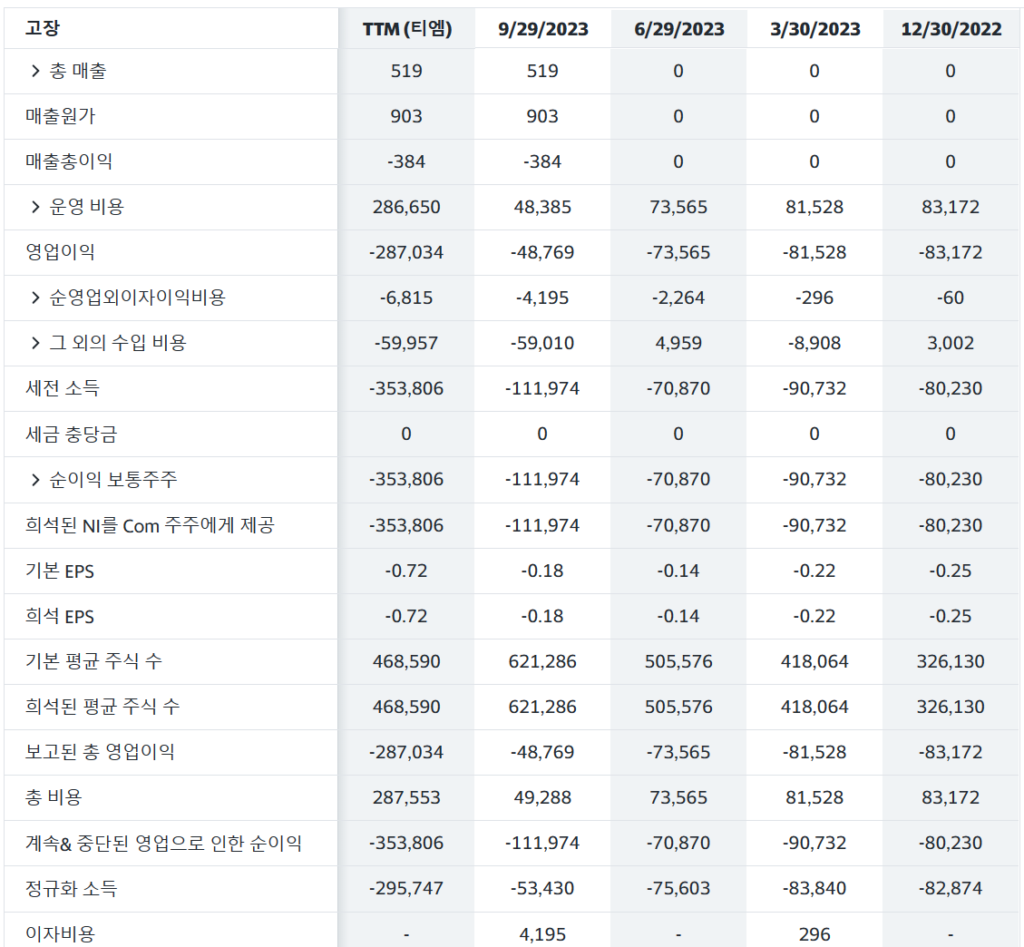

At the heart of Canoo's struggles was a persistently bleeding balance sheet, characterized by substantial and escalating net losses. Financial statements painted a grim picture, consistently showing the company burning through capital without achieving the necessary production volumes or revenue streams to offset its expenditures. For instance, the company reported a net loss of approximately $488 million in 2022. This trend continued into 2023, with another significant net loss of around $302 million. Cumulatively, these losses amounted to over $900 million between 2022 and 2024, a staggering sum for a startup that was still far from achieving profitability or even significant production scale. These figures were a major source of concern for investors, who watched their investments erode as the company's financial health deteriorated.

The inability to stem these losses and achieve positive cash flow became a critical impediment to Canoo's survival. Building an automotive company from the ground up requires massive upfront investment in research and development, manufacturing facilities, supply chains, and a workforce. Without consistent and substantial revenue generation, companies must rely heavily on external funding, typically through equity offerings or debt. However, a continuous pattern of heavy losses makes it increasingly difficult to attract new investors or secure favorable financing terms. This vicious cycle of cash burn and dwindling capital ultimately trapped Canoo, making its long-term viability increasingly questionable and intensifying investor worries about the future of GOEV.

The Stock Market's Harsh Verdict: GOEV's Plummeting Value

The stock market, an unforgiving arbiter of corporate performance, delivered a brutal verdict on Canoo's prospects. From its initial listing, Canoo's stock price embarked on a steady downhill trajectory, a stark contrast to the initial hype that surrounded its debut. While the broader "EV bubble" led by Tesla offered some temporary reprieve and investor interest, Canoo's shares could not sustain any meaningful recovery. The company's stock, which once traded at significantly higher levels, plummeted to a mere $0.37, effectively putting it on a path towards delisting. This precipitous decline represented an astonishing drop of over 99% from its peak valuation, wiping out nearly all shareholder value.

In a desperate attempt to stave off delisting due to its low share price, Canoo announced a reverse stock split. This corporate action, which consolidates existing shares into fewer, higher-priced shares, is often a last-ditch effort by companies to artificially inflate their stock price to meet minimum listing requirements. However, a reverse stock split rarely addresses the underlying financial and operational issues plaguing a company. For Canoo, it was a clear signal of its dire situation, and ultimately, it proved insufficient to reverse the tide. The experience of investing in Canoo served as a painful lesson for many, reinforcing the adage that even in exciting, high-growth sectors like electric vehicles, "penny stocks" or highly speculative ventures can lead to devastating losses. It underscored the critical importance of rigorous due diligence and a cautious approach to investments in companies with unproven business models and persistent financial deficits.

The Inevitable End: Chapter 7 Bankruptcy Filing

Despite various attempts to stay afloat, including the reverse stock split and a headquarters relocation, Canoo's financial struggles proved insurmountable. The inevitable end arrived in January 2025, when Canoo Inc. filed for Chapter 7 bankruptcy protection in the U.S. Bankruptcy Court for the District of Delaware. Reports from Reuters and other foreign media outlets indicated that the company filed its petition on January 17th, with some sources specifying January 21st as the official filing date. This filing marked the immediate cessation of all company operations, bringing an abrupt end to an eight-year journey that began with so much promise.

The bankruptcy filing revealed the dire state of Canoo's finances. According to submitted documents, the company's cash balance stood at a paltry $50,000, while its liabilities soared to $50 million. These figures painted a stark picture of insolvency, leaving no viable path forward for continued operations. The reasons cited for the Nasdaq delisting, which officially halted trading of GOEV shares on January 29th, directly stemmed from this bankruptcy filing. These included the Chapter 7 bankruptcy protection application, significant concerns about the residual equity for existing listed security holders, and the company's clear inability to consistently meet Nasdaq's listing requirements. For investors, this meant that their publicly traded shares would either be transferred to the over-the-counter (OTC) market or, more likely, become virtually worthless, cementing Canoo's fate as a failed EV startup and a stark example of the risks associated with investing in such ventures.

A Glimmer of Hope? The Arrival Acquisition

In a curious twist amidst its own struggles, Canoo made headlines for acquiring assets from another delisted electric truck startup, Arrival. Arrival, a UK-based company that also faced significant financial difficulties and eventually delisted from Nasdaq, had developed innovative manufacturing processes and vehicle platforms. Canoo's acquisition of these assets was reportedly aimed at lowering its own production costs and potentially accelerating its manufacturing capabilities. This move, however, was met with skepticism rather than renewed investor confidence. The news of Canoo acquiring assets from a bankrupt company, rather than signaling a turnaround, often fueled further concern about its own financial stability and strategic direction.

While the theoretical benefit of acquiring valuable intellectual property or manufacturing equipment at a distressed price can be appealing, the practical implications for a company already on the brink of bankruptcy are complex. For Canoo, the acquisition of Arrival's assets, instead of being a catalyst for recovery, seemed to highlight its desperate situation. Investors questioned whether a company struggling with its own cash flow and production challenges could effectively integrate and leverage assets from another failed venture. This move, despite its stated goal of cost reduction, did little to alleviate concerns about Canoo's fundamental viability and ultimately did not prevent its eventual bankruptcy and the permanent delisting of its stock.

Beyond the Financials: Operational Shifts and Industry Warnings

Beyond the stark financial figures and regulatory battles, Canoo also underwent significant operational shifts in its final years. Notably, the company announced a relocation of its headquarters from California to Texas, specifically to Justin, a satellite city of Fort Worth. This move was presented as a strategic decision, potentially aimed at leveraging a more favorable business environment or closer proximity to potential manufacturing sites. However, such a significant relocation can also be disruptive and costly, adding another layer of complexity to an already struggling operation. While some companies successfully navigate such transitions, for Canoo, it was another development amidst a series of challenges that seemed to outweigh any potential benefits.

Canoo's demise also served as a potent warning to the broader electric vehicle industry, particularly for cash-strapped startups. Its collapse followed closely on the heels of other EV companies facing severe financial distress, such as Fisker, another U.S. EV manufacturer that also delisted from the New York Stock Exchange. The industry has witnessed a wave of bankruptcies, delistings, and restructurings, affecting not just manufacturers but also charging infrastructure companies. Experts and analysts have repeatedly warned about an impending "shakeout" in the EV market, predicting widespread failures, delistings, and consolidations, especially for startups lacking robust cash flow and a clear path to profitability. The experience of Canoo, along with others, underscores the brutal reality that while the EV market holds immense potential, it is also incredibly capital-intensive and unforgiving for companies unable to scale production, manage costs, and secure consistent funding.

Lessons from Canoo's Collapse: A Cautionary Tale for Investors

The story of Canoo's rise and spectacular fall offers several crucial lessons for investors, particularly those new to the stock market or tempted by the allure of high-growth, speculative ventures. Firstly, it highlights the immense challenges of scaling production in the automotive industry. Developing a prototype is one thing; mass-producing vehicles efficiently and profitably is an entirely different beast, requiring billions in capital and years of execution. Canoo's persistent struggle to move beyond limited production runs and its continuous cash burn were red flags that ultimately led to its bankruptcy and the delisting of its shares.

Secondly, the experience with Canoo underscores the importance of scrutinizing a company's financial health, especially its cash flow and debt levels. Despite the innovative concepts and initial hype, Canoo's balance sheet consistently showed deep losses and dwindling cash reserves. For novice investors, the temptation to chase exciting narratives or "the next Tesla" can be strong, but the cold, hard numbers often tell a more accurate story. Companies with chronic unprofitability and a reliance on continuous external funding are inherently risky. The fact that Canoo's stock dropped 99% from its high point is a stark reminder that speculative investments can lead to total loss.

Finally, Canoo's fate, mirroring that of Fisker and others, reinforces the broader warning about the volatility and consolidation expected in the EV startup sector. While the long-term outlook for electric vehicles remains positive, the journey for individual companies is fraught with peril. Investors should exercise extreme caution, conduct thorough due diligence, and understand that even companies with promising technology can fail due to poor execution, insufficient funding, or intense competition. For those considering investments in highly speculative stocks like Canoo (GOEV) was, the best advice is often to avoid them altogether, especially if they are new to investing. The market's strict rules, like those leading to Canoo's delisting, are in place to manage risk, and when a company fails to meet them, it's a clear signal for investors to exit and not look back.

Conclusion

The journey of Canoo Inc., from an innovative electric vehicle startup to its eventual delisting and Chapter 7 bankruptcy, serves as a poignant narrative of ambition meeting the harsh realities of a capital-intensive industry. Once heralded as a potential disruptor with its unique designs and modular platform, Canoo ultimately succumbed to persistent financial losses, an inability to scale production, and a failure to meet Nasdaq's stringent listing requirements. Its stock plummeted, wiping out virtually all shareholder value, and its operations ceased, leaving behind a legacy of unfulfilled promises and a significant cautionary tale for the investment community.

Canoo's story is a powerful reminder that innovation alone is not enough to guarantee success in the fiercely competitive automotive market. Robust financial management, efficient execution, and a clear path to profitability are equally critical. For investors, particularly those drawn to high-risk, high-reward ventures, the collapse of Canoo underscores the imperative of thorough due diligence, understanding financial statements, and recognizing the inherent volatility of speculative stocks. We hope this comprehensive look into Canoo's downfall provides valuable insights into the challenges of the EV sector and the importance of informed investment decisions. What are your thoughts on Canoo's trajectory, or perhaps, what other EV startups do you believe face similar challenges? Share your perspectives in the comments below, and consider exploring our other articles on market trends and investment strategies.

Mysterious financier asks judge to stop Canoo asset sale | TechCrunch

카누 주가 전망 (GOEV), 역주식 분할, 상장폐지?, 주가 하락 이유 - 아미 블로그

Q. 자진상장폐지가 무엇인가요?